NHC is a thermal coal producer which is less attractive to MM than its Coking/metallurgical (Met) coal peers but this is a story primarily around yield as opposed to growth. We believe more than enough bad news is built into the NHC share price, and with its $100mn buyback supporting the stock, it looks good for yield investors with a slightly higher risk tolerance. We estimate a ~10% fully franked yield on offer over the coming year, although this could increase if the coal price continues to improve.

Note that while we anticipate a structural decline in thermal coal over the coming decades, we also expect supply and demand imbalances to build in the relatively short term, which will support earnings and dividends.

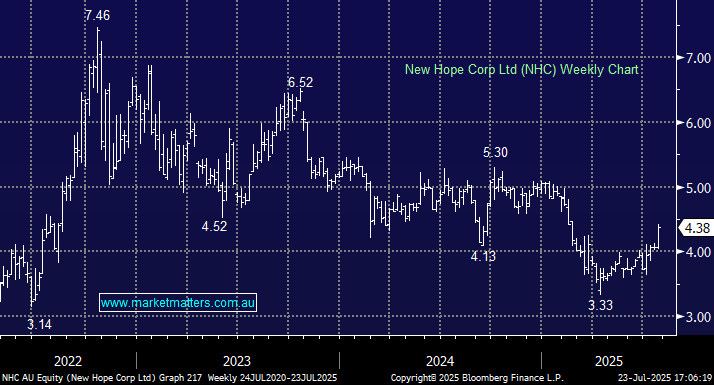

- We are looking for NHC to initially test $5, or 14% higher. MM holds NHC in our Active Income