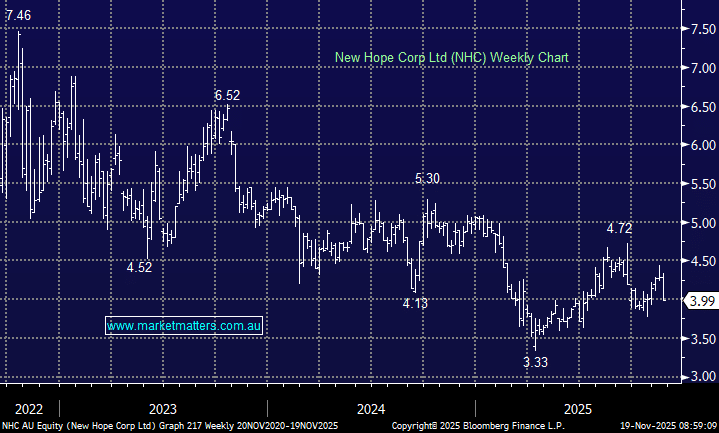

NHC released their 1Q26 update on Monday, and it was met with some selling, dragging shares down ~7%, albeit, in a soggy market. The production update was mildly softer than expected, largely due to weather impacts that disrupted site access and slowed run-of-mine (ROM) output. While the headline numbers won’t excite the market near-term, the investment case for NHC remains solid, in our view. Despite weak coal pricing, NHC continue to show discipline in execution which is driving solid free cash flow and yield, which is why we continue to think patience is warranted.

The key takeaways:

- ROM production: 3.87mt – down 5% QoQ and below forecasts

- Coal sales 2.68mt up +12% QoQ

- Underlying earnings (Ebitda) $107.9m, up 15.5% QoQ.

NB: The mismatch between ROM and sales was mostly driven by wet-weather remediation, something that should gradually normalise as we move through FY26.

NHC reaffirmed a solid medium-term production profile with FY26 production of 15.7–17.7mt and coal sales of 10.2–11.5mt. The key here is the increasing contribution from New Acland Stage 3, combined with a steady Bengalla output base. While Maxwell Mine isn’t in formal guidance, early-stage production is underway and expected to ramp through FY26 — a future upside driver.

Even in today’s challenging coal price environment, NHC is well-positioned to deliver low-cost, high-margin cash flow, supporting a solid yield (consensus 6.7% fully franked). Importantly, they are favouring dividends over share buy-backs at this stage, largely due to a big franking credit balance (~$900m) discussed on the call with management. If coal prices turn up, which is our expectation on more benign global supply growth, then NHC will be very well positioned to increase fully franked dividends further – the main reason we remain long in the Income Portfolio.

- There is no change to our thesis: NHC remains a solid, high-yielding position where patience remains the play. Production grows in FY26, and we still think coal markets are likely to tighten, underpinning a recovery in prices.