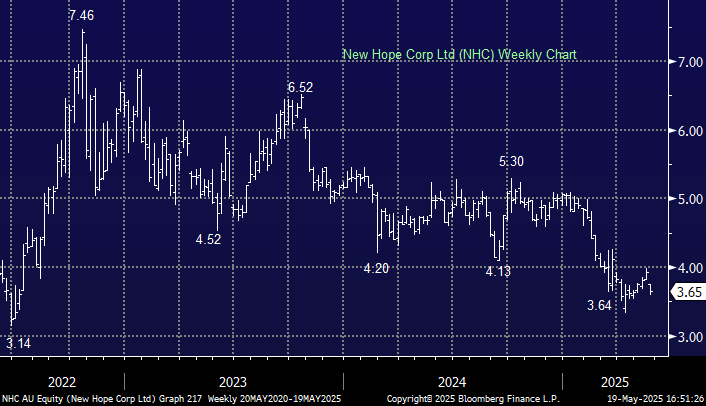

NHC –7.12%: Posted their third-quarter results adding insult to injury on a day where energy names were already drastically lower; the coal producer posted softer production figures and cut saleable coal production guidance for FY25.

- 3rd quarter saleable coal production 2.76 million tonnes, +1.1% q/q

- 3Q25 earnings before interest tax depreciation and amortization (EBITDA) $155.2 million, -27% q/q

- FY25 saleable coal production guidance 10.58 million to 11.57 million tonnes vs prior guidance of 10.83 million to 11.87 million

Management noted a sustained excess of thermal coal supply during the quarter, which has been clearing, and it appears the market is now finding a floor around the $US100/t mark. Whilst a disappointing quarterly from a production perspective, lower numbers are now baked into the share price. Management has a track record of excellent cost control so with coal prices supported by the seasonal uptick in electricity demand during the Northern Hemisphere summer, we see the stock as well positioned through the rest of the year.