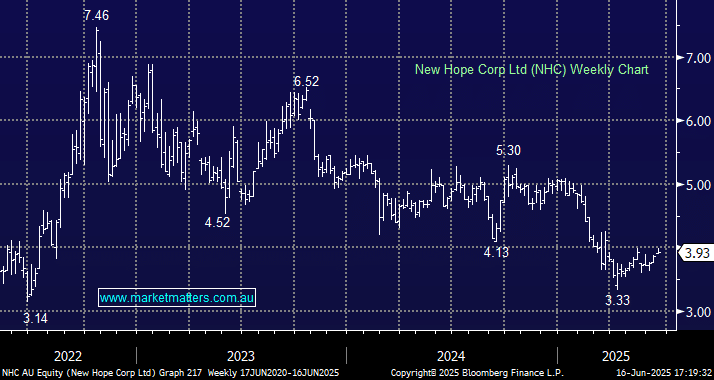

NHC is a thermal coal producer which didn’t help its shareholders last month when it posted softer production figures and cut saleable coal production guidance for FY25, though we note the stock held up ok. We believe more than enough bad news is built into NHC share price and with interest rates set to fall over the coming year and its $100mn buyback announced in March, supporting the stock, it looks good for yield investors with a slightly higher risk tolerance. We estimate a ~10% fully franked on offer over the coming year, although this is naturally commodity price dependant. Note that while we anticipate a structural decline in thermal coal over the coming decades, we also expect supply and demand imbalances to build in the coming years, while will support earnings, and, consequently, dividends.

- We are initially targeting a retest of the $5 area through 2025/6: MM holds NHC in its Active Income Portfolio.