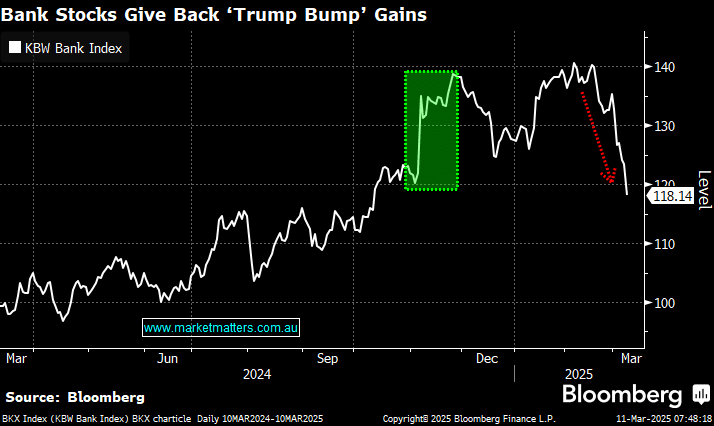

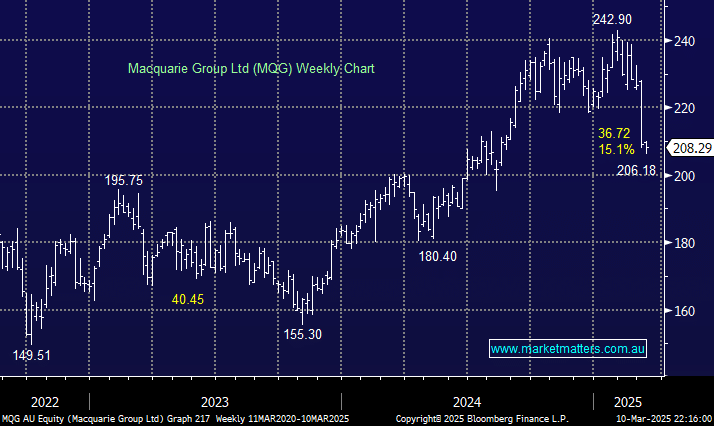

MQG has endured a sharp 15% correction over the last few weeks, following its US peers lower i.e. Goldman Sachs (GS US) is down over 20% and JP Morgan (JPM US) over 15%. Initially, US banks soared after President Trump’s landslide victory in November around optimism toward deregulation and tax cuts. However, the escalating trade war has raised alarms about a potential recession. Indicators such as declining consumer confidence and reduced industrial activity suggest a slowing economy, which is not good for the banks. The sentiment pendulum has swung from too optimistic to too pessimistic.

- We like the risk/reward towards MQG around $200, we may tweak our 4% position to 5% – MM holds MQG in our Active Growth Portfolio.