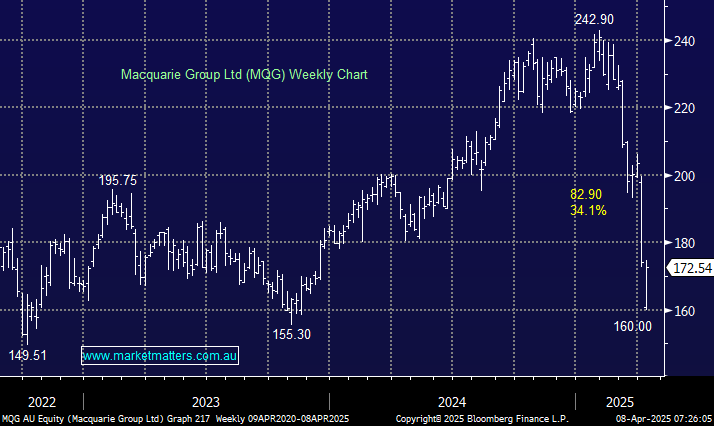

MQG has been “smacked” well over 30% in the last few months, not helped by the fact that around 33% of its revenue comes from the US. However, it doesn’t make cars or sneakers; it’s just vulnerable to a downturn in the underlying US economy. Macquarie Group generates revenue in the U.S. through a range of businesses, primarily focusing on infrastructure, asset management, commodities, and banking services. On the surface, Macquarie Capital is likely to struggle with M&A, capital raisings, and IPOs until certainty returns to the global landscape, although we did see a bid for Abacus Storage (ASK) yesterday. The likes of Goldman and JP Morgan have also fallen sharply due to recession fears, but we like the risk-reward ratio towards these household names after their sharp declines.

- MQG is now trading well below its average 5-year valuation with value on offer, in our opinion.

- We like MQG, considering increasing our position from 5% to 6%: MM owns MQG in its Active Growth Portfolio.