Plenty of companies were in presenting to fund managers and advisors over at Macquarie today in their yearly conference. The presentations are often used to update the market as to where companies are at in terms of their guidance for the year with less than 2 months until the end of the financial year. MM’s portfolios had 4 holdings present today with mixed fortunes

Super Retail Group (SUL) +0.69%, didn’t put forward guidance but did talk to strong LFL sales across the board. BFC saw the highest growth with 59% vs the first 44 weeks of FY20 while their biggest brand Supercheap Auto saw 21% LFL growth. The company did say the gross margin improvement seen in the 1st half has carried through but operating expenses will be higher as they play catch up on deferred investment from COVID.

Transurban (TCL) -0.14%, hosted their investor day yesterday so for the most part today’s presentation was a re-hash. Traffic is clearly recovering across all geographies, though at a slow pace. They talked up 7 opportunities available to them within the next 5 years including buying NSW’s 40% stake in WestConnex.

Ramsay (RHC) -0.24%: talked to continued improvement across the board. UK & Europe businesses are continuing to support the COVID effort which has weighed on admission numbers, though they have seen some improvement in the third quarter. Australian volume trends are turning however there is a clear correlation with lockdowns and weakness in surgical numbers.

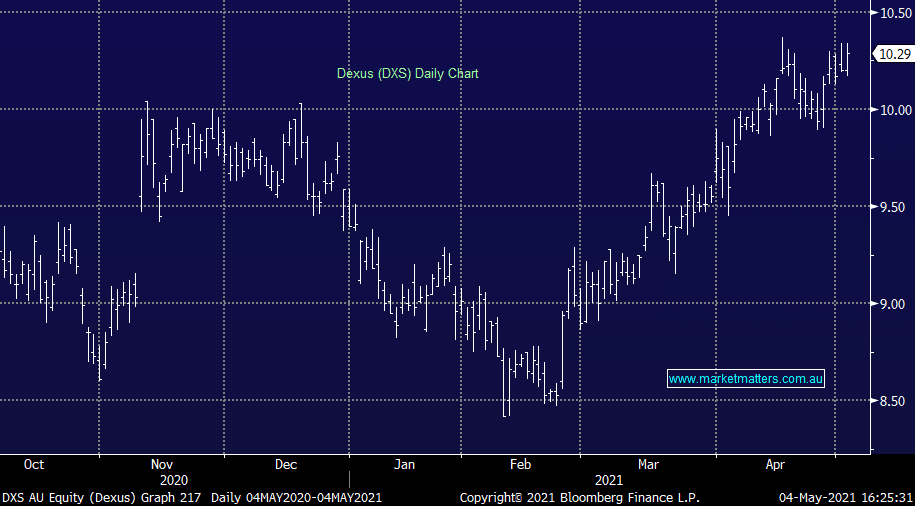

Dexus (DXS) +0.88%, saw occupancy fall 0.6% in the last quarter and incentives rise in their office portfolio in the March quarter. The market seems somewhat prepared for a bit of volatility in these numbers so long as the trend remains up and people are returning to work. They maintained guidance which was the most important thing really.