Focused on integrated delivery, Lynas is a miner and supplier of high-grade REE’s, with its Mount Weld asset in Western Australia one of the highest-grade REE mines in the world. Lynas has now announced that it will aim to produce separated Heavy Rare Earths (HRE) products from CY25. Traditionally, the commercial focus of the market on LYC has been on neodymium and praseodymium (NdPr) as the primary driver of revenue. Still, we are wary of the opaque nature of HRE, which is even less transparent than NdPr. However, we see LYC’s entry into HRE refining as a potential precursor to future 3rd party processing, and much of this optionality is not built into today’s price.

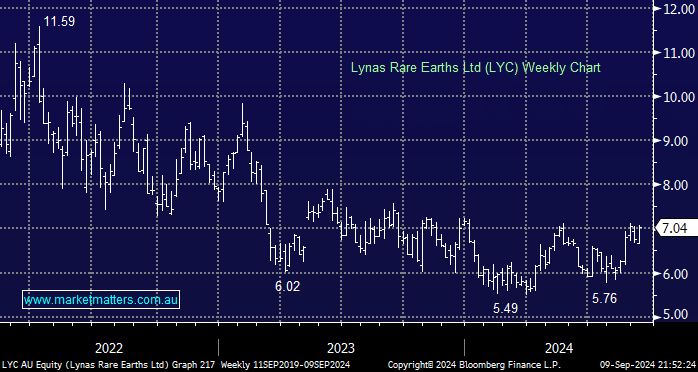

- Valuing LYC is hard, but we’ve witnessed a number of times in 2024 that the strong are getting stronger, and in terms of REE, that’s LYC, especially in a world scarred of being reliant on China for anything. We believe LYC represents good value ~$7, but it’s an aggressive play for a $6.6bn business that’s a political hot potato heavily influenced by China.

We are initially targeting around 20% upside for LYC – a stock that could find itself back in our Emerging Companies Portfolio.