Lynas Rare Earths, a leading producer of rare earth materials outside China, reported a 5.9% decrease in revenue for the first quarter of the 2025 fiscal year, totalling $120.5 million. The decline was attributed to sustained low prices for strategic minerals and subdued demand during the quarter. The average selling price for Lynas’s product range fell to A$42.5 per kilogram, compared to A$46.9 per kilogram in the year’s corresponding period—another China-facing company struggling for traction.

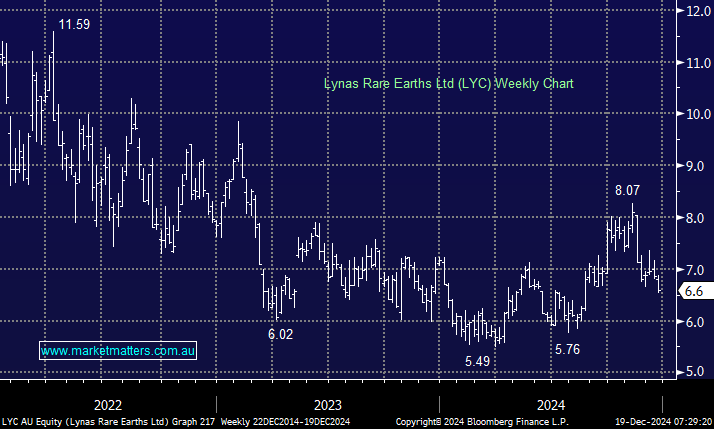

LYC aims to produce separated Heavy Rare Earths (HRE) products from CY25. Traditionally, the commercial focus of the market on LYC has been on neodymium and praseodymium (NdPr) as the primary driver of revenue. Still, we are wary of the opaque nature of HRE, which is even less transparent than NdPr. However, we continue to see LYC’s entry into HRE refining as a potential precursor to future 3rd party processing, and much of this optionality is not built into today’s price. Valuing LYC is hard and although we believe LYC looks interesting ~$6-6.50 it’s an aggressive play for a $6.2bn business that’s a political hot potato heavily influenced by China.

- We see an improving risk/reward picture unfolding for LYC, but there’s no catalyst to buy yet.