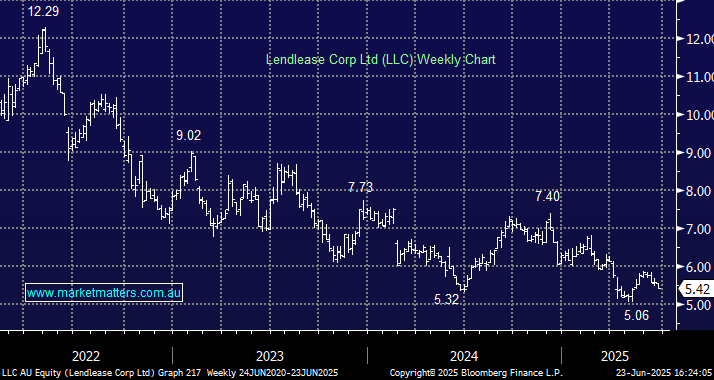

LLC has been a huge market underperformer over recent years, demonstrating the ability to get almost everything wrong it possibly can. However, its ongoing pivot toward high-end residential, luxury apartments, and build-to-rent feels well-timed for a change. Over 50% of LLC FY24 revenue came from residential development (based on completions). The debt burden remains a major issue for LLC, but falling interest rates should ultimately help on this front. While we have no interest in chasing this underperformer around the $5.50 area, a washout-style move on the downside could prove interesting from a risk-reward perspective, albeit for the brave.

The company is walking the path of asset sales, with some analysts talking buybacks as the cash comes in, with the company having just locked in $70mn for the sale of Capella Capital to Japan’s Sojitz. However, we believe that more sales are likely required first, given the net debt of approximately $3.5 billion at the end of the last financial year, above its targeted 15–20% gearing range – its goal is to get back into this band by the end of FY26, using the expected cash inflows.

- We would like the risk/reward towards LLC around the $5 area.