Lendlease has returned to profit in FY25 reporting a $225m net profit, reversing last year’s $1.5 billion loss, and lifting its full-year dividend by 44% to 23 cents. The company said FY26 will be a transition year, with EPS expected to fall to 28–34 cents due to fewer project completions, before rebounding in FY27. It reaffirmed plans for a share buyback of up to $500 million, tied to capital recycling progress. The improvement follows last year’s strategy reset, which streamlined operations, exited international construction, and prioritised core business performance and capital discipline, i.e. its going back to its knitting.

LLC has a $500 million share buyback ready to go, but it won’t get the green light until gearing falls from 26.6% to 15%, which means another $1.7 billion of debt needs to be paid down – prudent in our opinion. Nevertheless, the shape of the new, simpler LLC is becoming clearer, Lombardo is delivering on cost reductions, and the property cycle is turning. The company’s shares were up 6.3% on Monday, illustrating the market’s upbeat view of the news.

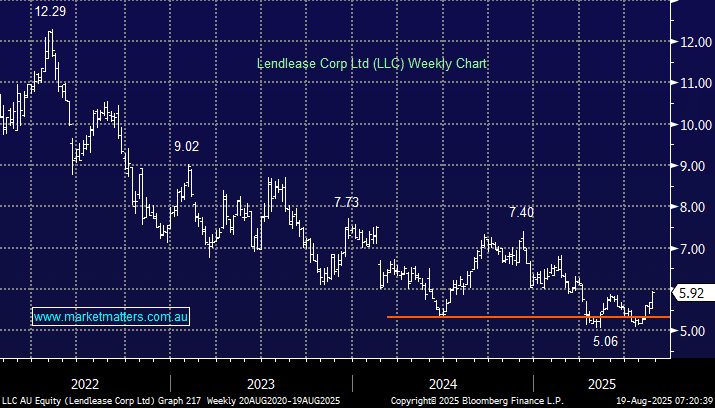

- We can see LLC testing $7 as investors reconsider the beaten-up Australian multinational construction, property, and infrastructure company, around 15-20% higher.