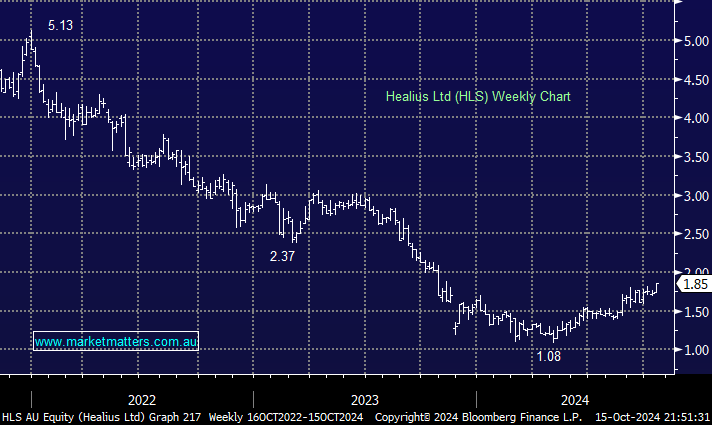

Pathology giant HLS surged +7.25% on Tuesday, making it the top performer on the main board. In the process, it posted fresh 12-month highs – yet interestingly, no news was crossing the wires. Analysts dislike this company as they did the resources before China fuelled a strong short covering rally: 4 Sells & 6 Holds with an average price target (PT) of $1.55, well below yesterday’s close – this data can be seen on the MM website. To compare HLS to the miners is a big stretch, but less than 3% of the stock is now held short after falling from above 8% a few months ago, i.e. the traders have recognised the stock’s turnaround potential, if not the analysts.

- We were questioned about our purchase last month due to the company’s poor performance in recent years but so far, so good.

Our thesis was based on HLS being a turnaround play after its recent results, with its balance sheet woes likely to end in the foreseeable future. Soon afterwards, HLS sold its Lumus radiology business to Affinity Equity Partners for $965mn, a far better price than most pundits expected, shoring up its balance sheet in the process. For example, Macquarie believed Lumus was worth between $590 million and $710 million.

With revenue of $475 million for FY24, Lumus represented about 28% of Healius’ sales. Still, shareholders will retain a sizeable pathology business and two smaller investments in day hospitals and Agliex Biolabs while having a “big chunk of change” to reduce the company’s liabilities. While we’re not investing for a takeover here, we think it’s a possibility for a private equity bid now that they are net cash, which can PE can strip out, and reload up with debt. Sounds crude, but that is the PE playbook!

- HLS is not unfamiliar with receiving bids with Australian Clinical Labs having a tilt late last year before the ACCC blocked the move.

HLS may have already bounced strongly from its 2024 low, but we see further upside while a bid is simply potential cream on the cake.

- We can see HLS well above $2 as a “cashed-up market” searches for value – MM is long HLS in our Active Growth Portfolio.

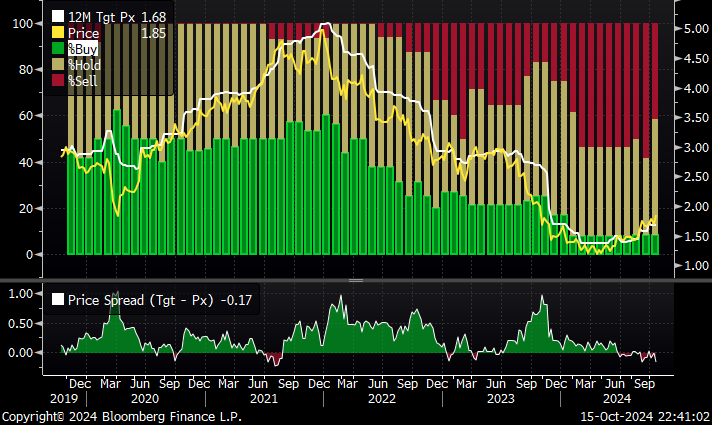

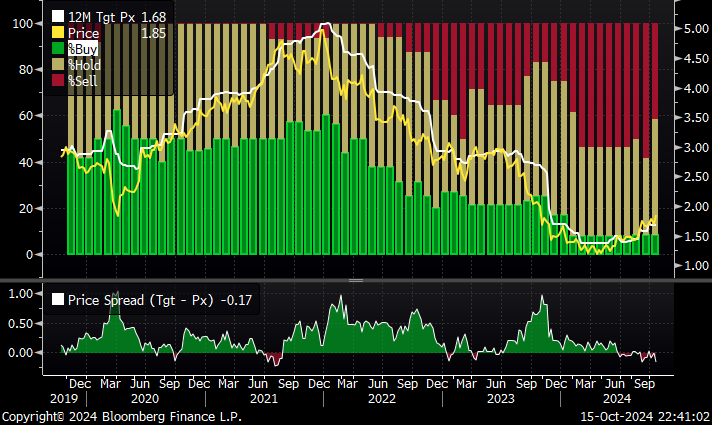

After pointing out the net bearish outlook of analysts towards HLS, we thought it was worth looking at how well they’ve called it, and the answer was interesting:

- The analysts provided a good leading indicator for the downturn in HLS, with a few turning negative before the stock fell away in 2022.

- At this stage, there’s a glimmer of “less negativity” creeping into the analyst’s consensus outlook, which could signal an improvement for the stock, but there’s nothing concrete yet.

For obvious reasons, we love reliable leading indicators at MM, but unfortunately, in this case, it’s too early to call.

NB, the PT on Bloomberg is $1.68, slightly above Refinitiv as the pool of analysts is slightly different.