HLS soared +12.9% on Wednesday following its FY24 result, which beat the average analyst estimates. Margin improvements caught the eye, plus the potential for some value accretive asset sales.

- Underlying EBIT of $65.4mn, -34% yoy, came in better than estimates of $61.2mn.

- Revenue of $1.75bn was up +2.3% yoy and free cash flow of $239.2mn was down -18% yoy.

- While they reported a small underlying loss, that was expected.

- No dividend was announced.

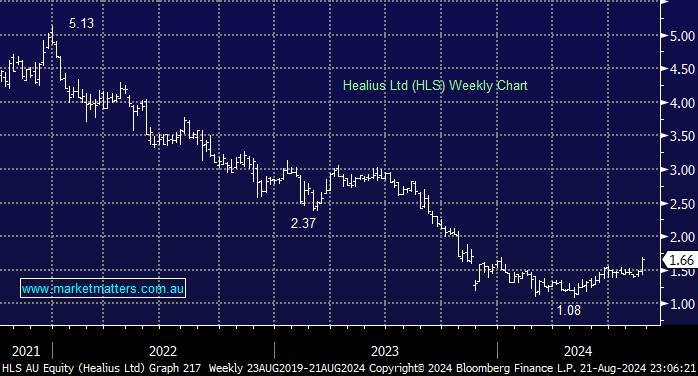

The process of selling off Lumus Imaging is well advanced, which will help further reduce the company’s Net debt of $360.7mn, which already fell 19% year over year. Encouragingly, volume growth in pathology has continued during July & August, improving by over 4% compared to 2023, which was the key to yesterday’s move. The other important aspect is gearing, their balance sheet is stretched, though they said gearing will remain within bank covenants and is intent on resuming dividends asap. Clearly a tough few years for HLS, though we now believe they’ve turned the corner.

- We have added HLS to our Hitlist following this better than feared update, and tangible signs that a turnaround is underway.