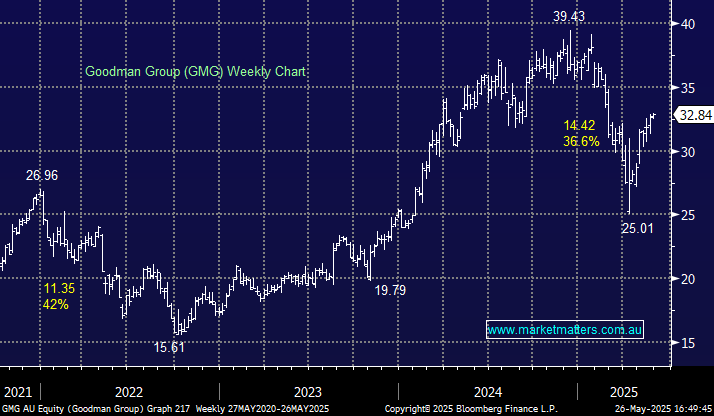

The GMG share price has endured a tough year after raising $4bn at $33.50 in February for data centre (DC) expansion, investors who bought into the raise are still down 2%. We remain fans of GMG’s industrial business and the future demand for data centres, and we remind subscribers that the recent capital raise is only ~6% of the company’s current significant $67bn market capitalisation. However, GMG’s push into Data Centres has changed the risk profile of the company, moving from a builder of sheds to high tech DCs. This has influenced how GMG trades, with the stock now becoming more ‘tech like’ in its characteristics.

- GMG update the market tomorrow, and it will be important. Consensus implies an upgrade in 2025 guided profit. GMG have a history of upgrading at this time of year, however, their focus has shifted, and this does create a greater level of uncertainty this time around.

In terms of valuation, there have been several recent transactions in the DC space, which imply that one gigawatt of data center infrastructure has a built value of ~$14 billion. GMG have a 4.5-gigawatt data center pipeline, on top of their industrial business. While GMG is not cheap, it can self-fund a lot of development on balance sheet, and it now has multiple drivers of growth moving forward.

We hold GMG for DC exposure because we believe the recent capital raise has dragged GMG down to a reasonable valuation while adding the spice of an AI/DC trade in a relatively conservative manner.

- We are ultimately looking for a retest of the $40 area as GMG expands in to DCs: We are long GMG in our Active Growth Portfolio.