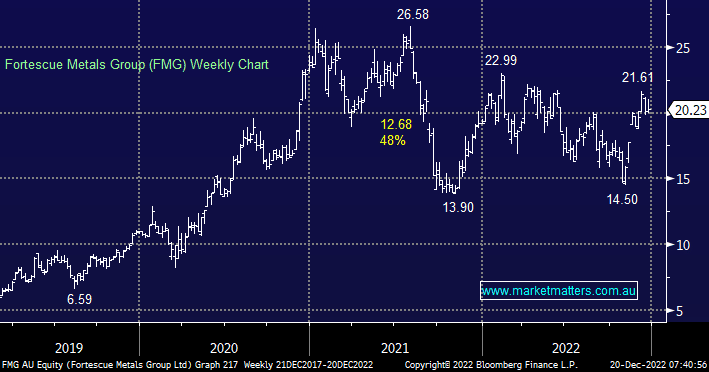

The miners and in particular iron ore names are directly correlated to the Chinese economy more than by tariffs but we felt they warranted a mention today in the context of today’s report. The iron ore stocks are not our favourite place to be invested medium term but into 2023 they look cheap while still paying an excellent yield hence into weakness they are on our radar, especially if/when China fires its next salvos of stimulus.

- We like the risk/reward towards FMG on dips back towards $19 – not a big ask for this volatile beast.