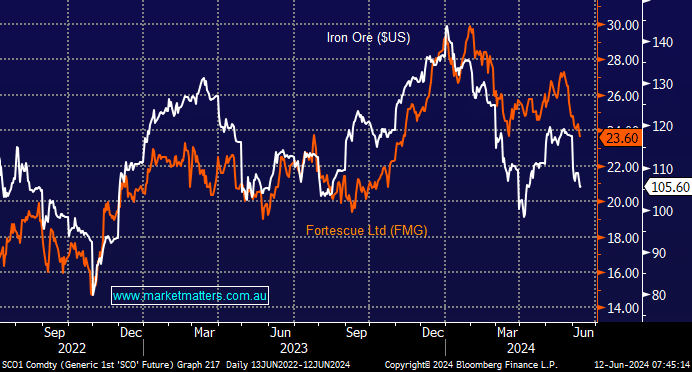

Buying commodity stocks for income is a risk. Their earnings are cyclical and so too are their dividends, which increases portfolio volatility and reduces the certainty of returns. In other words, we think there needs to be a very compelling reason to own commodities in an income-focused portfolio that is designed for investors looking for sustainable income with significantly less volatility than the market. This morning, we asked the question, is Fortescue Metals (FMG) throwing up such an opportunity, having pulled back ~20% and offering a ~10% fully franked consensus yield for the coming 12 months, starting with a A$1.50 dividend in early September? Grossed for franking, $1.50 is worth $2.14, and if we get the timing right on the stock, this is worth considering.

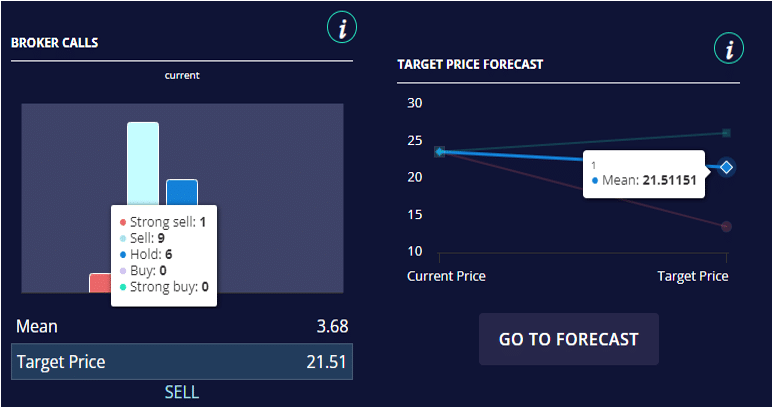

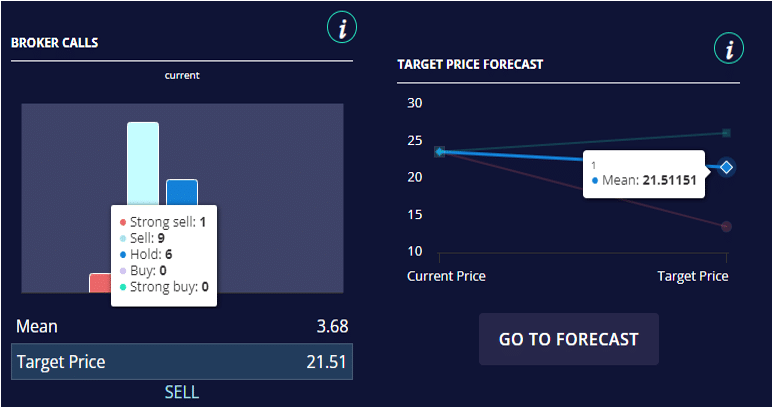

The market is universally bearish on FMG. Of the 16 analysts who cover the stock, 10 sells and 6 holds are predicated on two main reasons.

- Iron Ore prices will fall due to increased production globally, reducing FMG’s earnings in the coming years. Share prices ultimately follow earnings over time.

- FMG Energy is a variable, with the concern being that the push into renewables will impact other areas, it’s tough/expensive trying to solve problems here, albeit, important ones.

In the short term, there is also their ability to meet FY24 production guidance which relies on a big Q4, along with general weakness across commodities and Iron Ore specifically, with the price now sitting at $US105.60/dmt, down around 20% from recent highs.

- We are interested in FMG as a shorter-term income play for the upcoming dividend. Trade location is very important. Noting that to accrue franking credits, the position needs to be held for 45 days; We are adding FMG to our Hitlist.