Iron Ore market fundamentals have been tighter than many expected on a range of factors, which has seen Iron Ore prices stay firm and trade comfortably above $US100/mt. The Iron Ore stocks have been solid as a result, with Rio Tinto (RIO) trading to new all-time highs while Fortescue is up more than 60% from 2025 lows. While sell-side analysts have been reluctant to raise earnings forecasts, the buy-side (Fund Managers) have been timelier, bidding up prices of the respective stocks pre-empting further consensus upgrades to come as Iron Ore prices defy an increase in supply coming from the Simandou iron ore project in Guinea, which officially began production on 11 November.

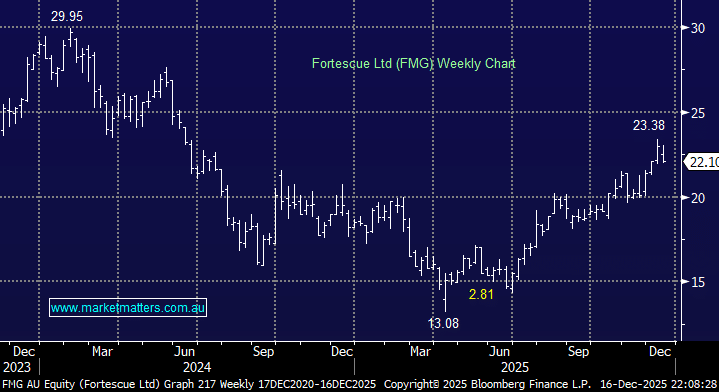

We continue to own Fortescue Metals (FMG) in the Income Portfolio, although we remain mindful that conditions are likely to ease as Simandou ramps up over the next three years. That said, FMG’s recent performance has been hard to fault. Shipments, costs and pricing all delivered, reinforcing the company’s position as one of the lowest-cost iron ore producers globally.

Encouragingly for FMG:

- Low-grade discounts are expected to remain narrow, as lower-quality ore will be required to blend higher-grade Simandou material

- Management expects the iron ore price to normalise around US$90/t, which remains workable for FMG’s cost base

The steel market outlook is “OK”, with Chinese exports holding up and scrap collection muted, though there are some macro risks we are grappling with, which make us question whether we should hold or fold on our position. Principally, Chinese growth data remains on the softer side, and absent stimulus in early 2026, with increased volumes hitting the market, prices could pull back from here.

Countering the soggier macro backdrop is very good execution, with FMG remaining a high-quality, low-cost iron ore producer with strong cash flow and an attractive dividend (5.4% expected over the coming 12 months). Hence, after a strong run and with longer-term supply risks on the horizon, we’ve shifted to a more neutral stance above $22.

- We’re comfortable holding the stock in the Income Portfolio for now, but we see more balanced risk-reward from here for the Iron Ore names.