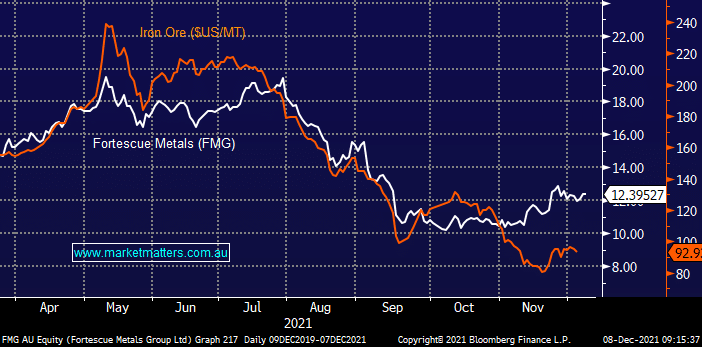

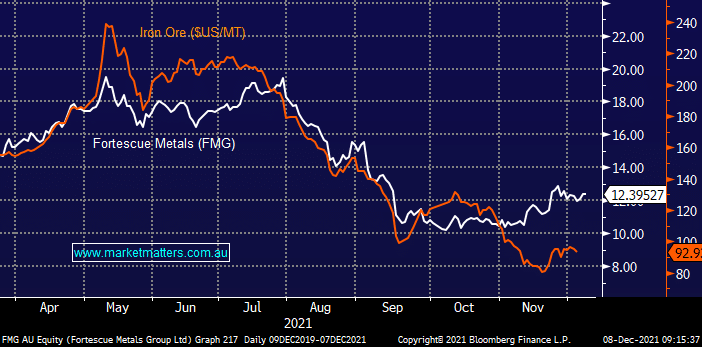

MM is holding FMG in our Growth Portfolio looking for a recovery after its 3-month 47% plunge in line with Chinas policy decisions which helped to hammer the iron ore price. However its important to notice that FMG bottomed well before the bulk commodity and in similar fashion its likely to end at least the 1st leg of its recovery before iron ore tops out – our initial target for iron ore is around $US120/MT or 10% higher, if this unfolds in the coming weeks we will consider if other resources stocks are lagging and hence are potentially better reflation vehicles into 2022 – more on this later.