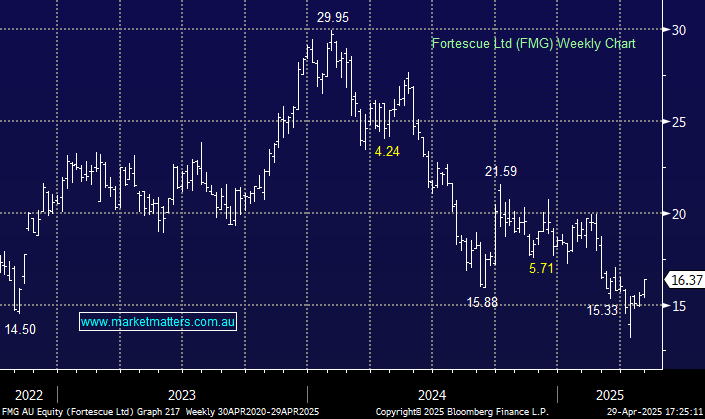

FMG +5.87%: The pure-play iron ore miner impressed with its 3rd quarter result showing a ramp-up of total iron ore production while maintaining full-year production and cost guidance despite adverse weather events.

- Total ore mined 55.5 million tons, +19% y/y

- Total iron ore shipments, 46.1 million tons, +6% y/y

- Cash balance at $US3.3 billion, net debt at $US2.1 billion

The solid numbers come after shipments and production numbers from BHP Group, Rio Tinto, and Vale SA were hit by disruptions from cyclones in Australia’s Pilbara and heavy rains in northern Brazil. FY25 shipped iron ore guidance was maintained at 190-200 million tons and should be achieved comfortably – iron ore shipments rose 6% for Fortescue in the quarter vs the year prior. Beyond, this expansion is set to continue as the miner ramps up its Iron Bridge project in addition to focussing on acquiring high-grade junior project such as Red Hawk Mining, located near FMG’s Solomon project in Western Australia