We included FMG this morning because it’s currently the highest-yielding ASX200 on historical numbers, which has proven to be a yield trap for many – a common issue for investors wearing blinkers. While we do not expect FMG to yield what it has in the past, our expectation for a fully franked dividend equating to 6.7% remains healthy.

Like all commodity companies however, their earnings are heavily influenced by the underlying commodity, which in the case of FMG is iron ore (Fe). Currently, the markets are almost universally bearish towards the resources sector, and Iron Ore in particular, having little faith that Beijing can lift its economy out of the doldrums anytime soon.

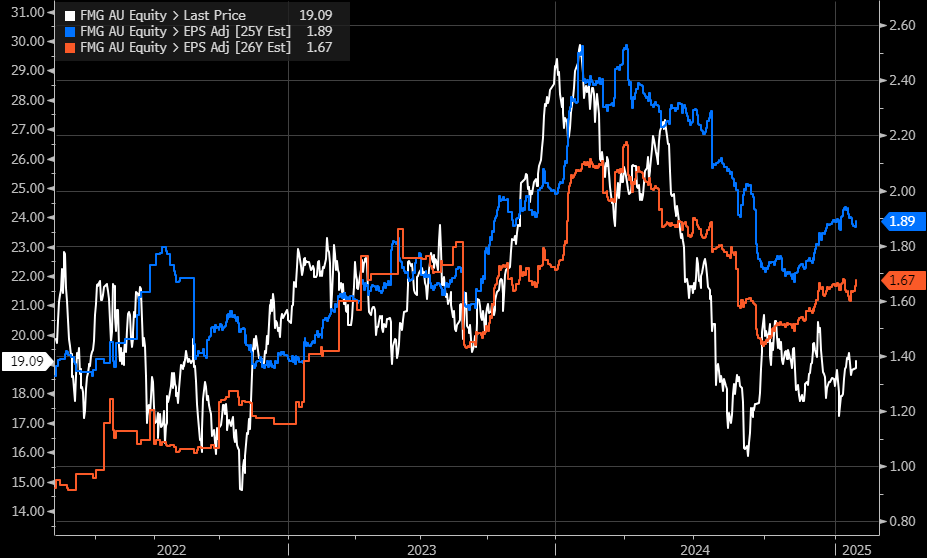

The chart below illustrates how FMG has fallen further/faster than earnings projections, illustrating the negativity surrounding the Fe space. While future supply is an issue, it’s known and therefore in the price already, and we would argue, Iron Ore’s resilience in the face of a lot of negativity, is actually a positive sign.

Fortescue is good at keeping costs contained across its Pilbara mines but in an environment of soft iron ore prices, earnings momentum will likely remain broadly negative on a 12-18-month view. Tight low-grade discounts provide a silver lining as China’s steel sector profitability is expected to remain challenging. We like the more disciplined approach to FMG Energy capital spend adopted in 2024, which will likely see FMG’s balance sheet remain strong and returns at healthy levels.

At MM, we are “Active Investors,” and this yield play is an excellent example of how we view stock generally. We like FMG ~$19, which has plenty of bad news already factored into its share price, but we wouldn’t adopt an “all-in ” approach, wanting to be able to average any exposure to potential future weakness.

- We like FMG into dips with a retest of $16, not out of the question in the markets current mindset – MM owns FMG in our Active Income Portfolio.