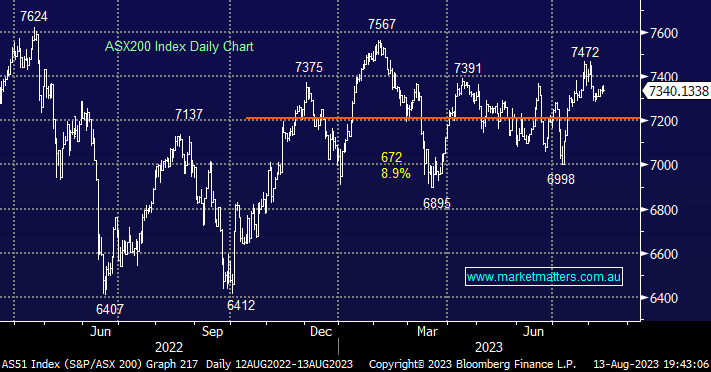

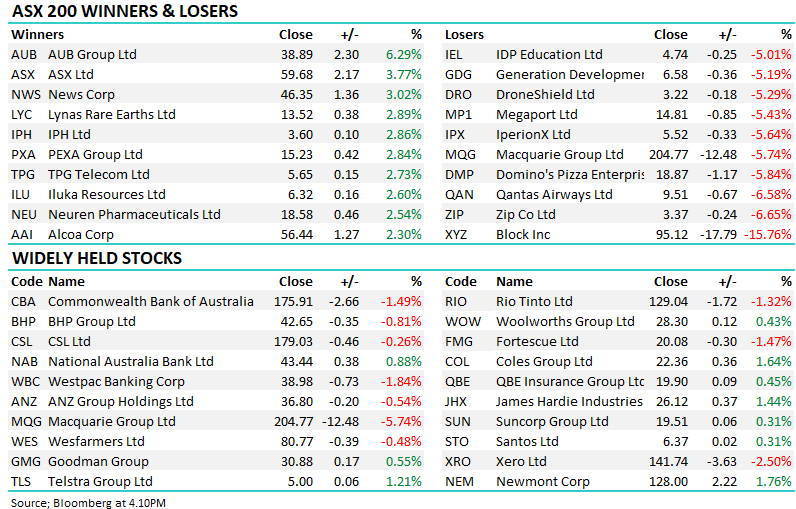

The ASX200 ended last week down -0.3% with the miners weighing on the index i.e. IGO Ltd (IGO) -4.9%, Mineral Resources (MIN) -2.5%, South32 (S32) -2.3%, and Fortescue Metals (FMG) -1.8%. Weakness in the rate-sensitive Tech and Real Estate Sectors also dampened sentiment as markets started to embrace a “Goldilocks” outcome for central banks i.e. inflation reined under control while a strong labour market helps the underlying economies remain firm – a very different story to the one unfolding in China.

We saw around 20% of the markets total capitalisation report results, and so far results have been solid, with earnings beats outnumbering earnings misses by a solid ratio of 3:1. However, analysts have continued to adjust down their outlook, with FY24 earnings being revised down by a ratio of 3:2. Reporting season will continue to dominate the local market this week with MM’s positions in Lendlease Corp (LLC), Treasury Wine (TWE), SEEK (SEK), ReadyTech (RDY), Bapcor (BAP), Dexus (DXS), Evolution Mining (EVN) all coming under the microscope in the first 3 days this week: MM Reporting Season Calendar

- The SPI Futures are calling the ASX200 to open down -0.4% on Monday with BHP slipping -25c in the US a likely drag along with the tech names.

US indices extended their August pullback last week with the tech based NASDAQ now down -4.6% month-to-date however we see no reason to panic, it’s both hardly a dent in the advance through 2023 and exactly what we’ve been targeting of late – followed by a buying opportunity. Not surprisingly it’s the “Magnificent Seven” tech stocks that have boomed this year that are experiencing most of the selling with the NYSE FAANG+ Index down -9.7% already, almost an official correction.

- No change, we remain bullish towards equities medium term while continuing to believe the market is now in the midst of our targeted tech-led pullback.

In our opinion the corrective nature of the Nikkei’s pullback over the last 9 weeks is encouraging from a bullish perspective, Japanese stocks have absorbed the BOJ starting to withdraw its ultra-loose monetary policy, this accumulation into bad news suggests the path of least resistance is on the upside i.e. we are targeting the 35,000 area in 2H.

- We like the risk/reward toward the Nikkei around the 32,000 area.