The ASX200 rallied to fresh 5-month highs last week courtesy of particularly strong performances from the Energy and Tech Sector but gains were broad based with all 11 sectors closing in positive territory. August commences on Tuesday and while it will kick off with the RBA decision we believe most of the tone of the market over the coming weeks will be dictated by reporting season – market expectations are fairly low but the current trend is misses aren’t being tolerated but the good news is being rewarded, it’s show time with volatility about to increase on the stock level.

- The SPI Futures are pointing to a solid open this morning, up around +0.3%, with tech stocks again likely to start on the front foot.

- No change, MM continues to believe this year will be dominated by moves on the stock/sector level as opposed to the underlying index i.e. more of the same.

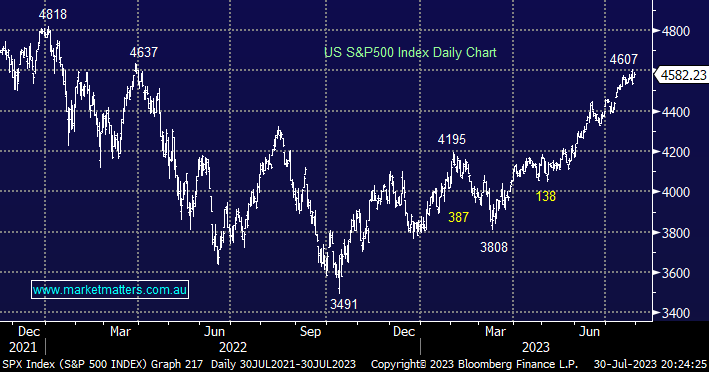

The broad based US S&P500 made fresh 16 month highs last week as reporting season passed the halfway mark – Overall, 51% of the companies in the S&P 500 have reported earnings for Q2 2023, and of these companies, 80% have reported EPS above market estimates. With expectations conservative at best the current results are proving solid enough to extend the bull market even higher, we see no reason for things to change in the coming weeks although upside momentum is slowing.

- We remain bullish towards equities but the market does feel overdue for a pullback/period of consolidation.

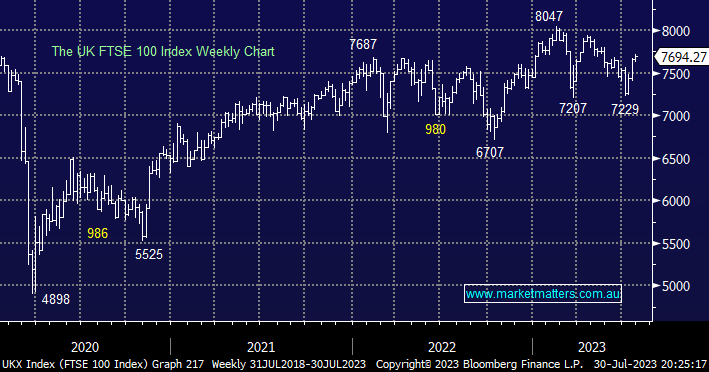

European equities pushed higher last week following the encouraging comments from Christine Lagarde, markets are looking for a bond yield top which could give stocks the platform to push the post-COVID highs although caution is warranted as upside momentum has in the past struggled above the 7700 level.

- The UK FTSE has remained firm whatever the news flow hence we have to favour another retest of 8000 through the 2H.