The ASX200 slipped marginally lower last week after enjoying a strong Thursday/Friday although May again lived up to its reputation ending down -3%. Last week saw the Materials stocks bounce back into favour although Tech was still the 2nd best performer while Consumer Discretionary & Staples stocks underperformed followed closely by the Financials.

- No change, we believe this year will be about “buy weakness and sell strength” while stock & sector rotation will continue to provide plenty of excellent opportunities under the hood.

- Tech has been the standout performer to date in 2023 although we believe the elastic band is stretching and we’re now adopting a more neutral view on its relative performance over the coming months.

Following Friday’s strong session on Wall Street the SPI Futures are calling the ASX200 to open around 7225 as the US Debt debacle fades into the background. Friday night in the US saw the S&P500 rally over +1.4% led by a +3.4% advance by the Materials stocks while the Tech Sector was relatively quiet closing up just +0.5% – we might just be entering a period of outperformance by the resources, it’s been a while!

- The SPI Futures are calling the ASX200 to open up over +1% this morning following a strong session in the US e.g. BHP is set to open up $1.15.

- From the expectations touched on earlier a rate rise, or 2, currently won’t come as a major surprise to market positioning locally.

The ASX has struggled compared to US indices over recent weeks as Tech stocks have led the line, this may change this week as the miners are set to open higher, the RBA is obviously the variable however if they do pause as flagged by Westpac, it will provide a healthy tailwind for local stocks.

The S&P500 continues to climb a wall of worry decimating the portfolio performance of the numerous non-believers along the way. While the Tech Sector continues to climb it feels to us like the rest of the market will play some catch-up as opposed to the likes of the Artificial Intelligence (AI) bubble bursting so early after NVIDIA’s (NVDA US) outstanding result.

- Our preferred scenario is the S&P500 will now test the 4500 area, or +5% higher.

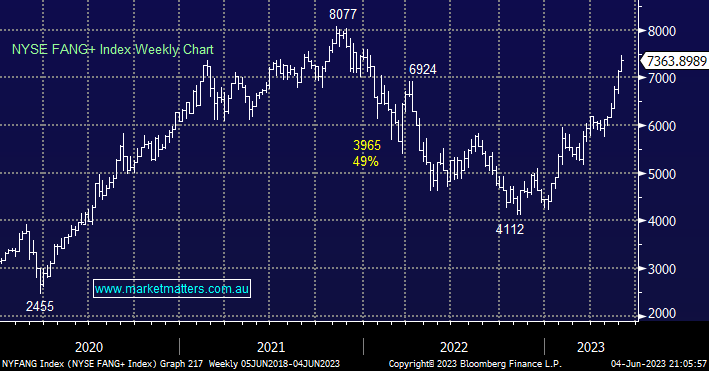

The NYSE FANG+ Index has sprung back to life over recent months with AI the latest market craze taking the highly traded growth index up over +80% from its November low. With Apple Inc (AAPL US) poised to make fresh all-time highs this week and Microsoft (MSFT US) not too far behind it’s hard not to adopt a positive stance toward tech and that’s before we consider the surge by NVIDIA.

- We have moved to a more bullish stance toward tech but our view remains the “easy money” is behind us.

- We are looking for a choppy appreciation up towards the 8000 area over the coming months.

- This means we will be fussy reducing our tech exposure across our portfolios for now.