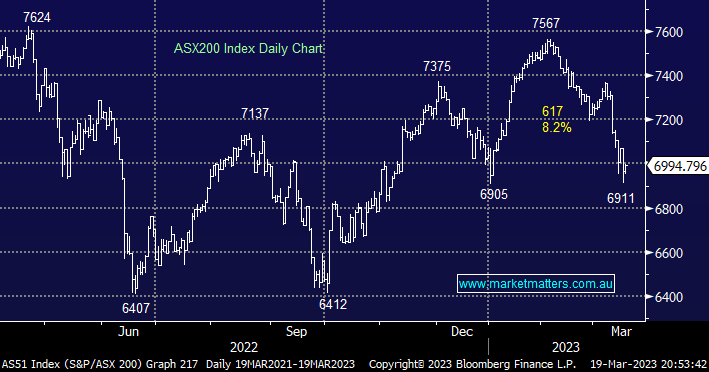

March has already delivered some significant volatility through bond and equity markets with this morning set to be another interesting session, the SPI Futures were pointing to a -1.4% drop on the open but the more than $3bn purchase of Credit Suisse by UBS over the weekend will make today a far more complex call. The recent global banking issues have elevated recession fears as financial institutions are likely to rein in lending making it harder for businesses to borrow hence the economy slows down i.e. ultimately what central banks wanted but not how they wanted to achieve it. The likes of copper and oil have been hammered on fears that such a slowdown will be deeper and more painful than many thought e.g. Friday saw Bent Crude Oil break below its 2022 low.

When the banking crisis is averted we are now still highly likely to see a dramatic slowdown in economic activity, Goldman Sachs lifted its chances of a recession by 10% last week, and the market voted with both feet on this front last week:

Winners: REA Group (REA) +5.2%, Newcrest Mining (NCM) +3.7%, Northern Star (NST) +3.2%, Xero (XRO) +3.2%, and CSL Ltd (CSL) +0.4%.

Losers: Woodside Energy (WDS) -6.2%, IGO Ltd (IGO) -4.8%, ANZ Bank (ANZ) -4.4%, South32 (S32) -4.2%, and BHP Group (BHP) -3.6%.

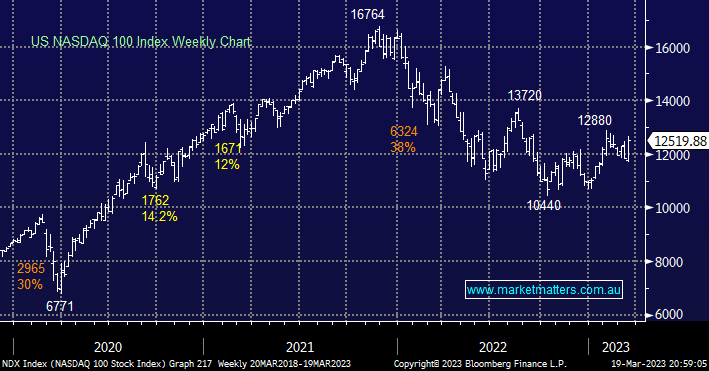

Less than 2 weeks ago markets were pricing in the Fed to reaccelerate its hawkish rate hikes, now bonds are expecting no rate hikes as financial stability takes precedence over inflation, at least short-term, hence the outperformance by growth stocks over their value counterparts.

US stocks fell again on Friday with the tech-based NASDAQ slipping -0.5% but for the week it closed up over +4% making a 4-week high in the process – as subscribers know MM is keen on markets that can rally on adverse news.

- No change, in our opinion the US NASDAQ 100 can weather this banking storm and rally towards 13,500 over the coming weeks/months.

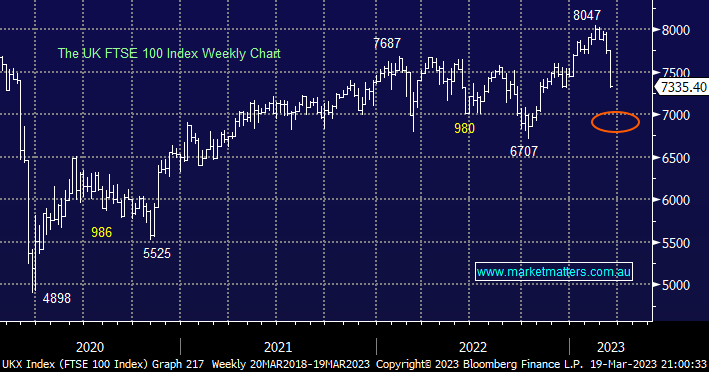

European stocks fell under the influence of the US banking crisis washing across the Atlantic Ocean onto its shores in the form of Credit Suisse, the rally by the FTSE above 8000 is now looking like a classic “false pop on the upside” i.e. a bearish read-through across Europe and the highly correlated ASX.

- The FTSE now looks very capable of dropping another 5-8%.

Although the market should improve tonight following the UBS deal the FTSE now looks like it’s correcting it’s phenomenal post-GFC advance.