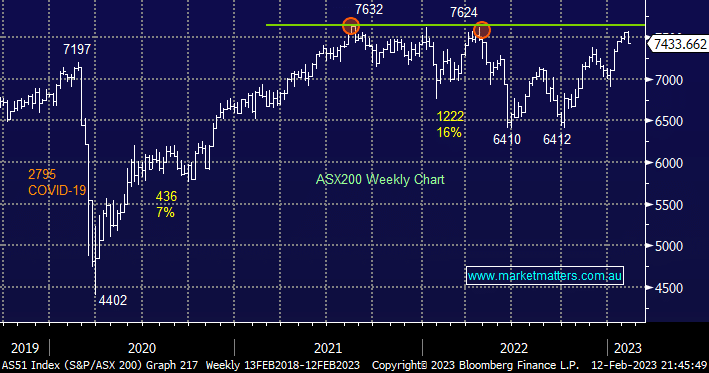

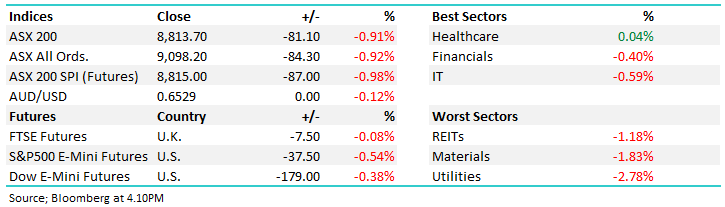

The ASX200 has started to struggle as bond yields turn higher and with the $US looking strong its hard to see the influential Resources Sector rallying short-term hence we are cautious towards the local index.

- No change, we are still looking to slowly de-risk into strength over the coming weeks although we are also buyers of decent dips on the stock/sector level – almost sound like a contradiction!

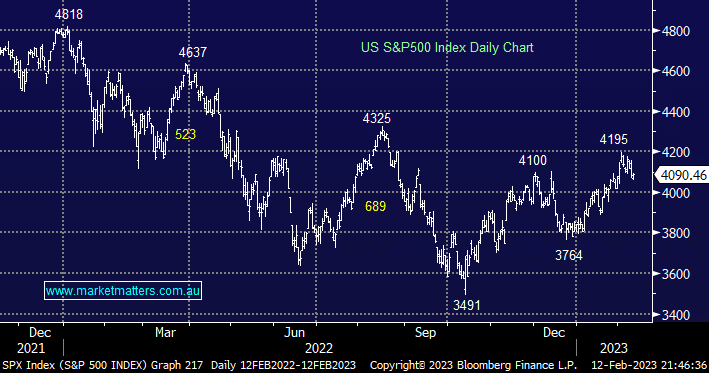

- We remain buyers of weakness and sellers of strength through 2023 and importantly we are now more skewed to the buy side, as opposed to the sell side as in 2022.

Last week saw the S&P500 pullback -3.2% but considering the hawkish comments from the Fed and extremely strong US Jobs Report we believe it’s been a resilient performance hence MM still believes we can see a test of the 4300 area over the coming weeks.

- On Friday US stocks recovered strongly from early losses dragged higher by the Energy and Utilities Sectors while the Consumer Discretionary stocks weighed on the index, moves which make sense if increasing recession fears are driving equities.

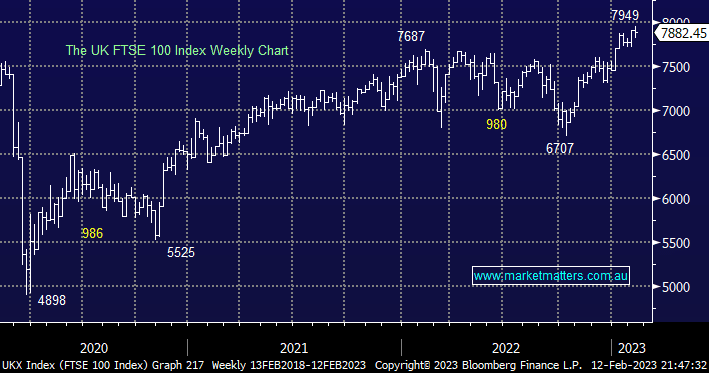

The UK FTSE again posted a new all-time high last week and while we aren’t keen on chasing the current strength there are clearly no signs of failure.

- We can see the FTSE above 8000 in the coming weeks as equities continue to shrug off theoretically bad news.