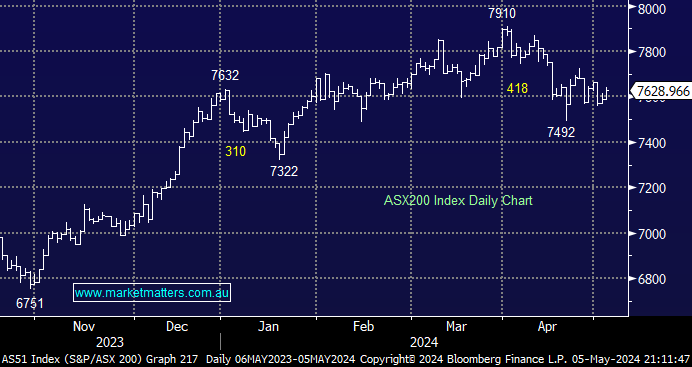

The ASX200 rallied +0.7% higher last week as easing bond concerns saw the rate-sensitive stocks/sectors recover strongly, e.g. The Real Estate +3.2%, Tech +2.3%, and Consumer Discretionary +2.1% sectors rallied. After Friday’s market friendly employment data, we expect more of the same at the start of the second week of May, aided by a more than 3% surge by US Tech following Apple’s (AAPL US) earnings beat – the US$2.8 trillion-dollar stock surged almost 6%.

- The SPI Futures are pointing to a +0.3% advance this morning after broad-based gains in the US on Friday night – BHP closed up 10c in the US.

US equities enjoyed easing bond worries last week, plus a solid earnings period to date, which so far has seen 77% of companies beat at the EPS line, with around 80% of the S&P500 having reported. During the past week, positive earnings surprises were reported by companies in a number of sectors, led by the healthcare and consumer discretionary, although positive quarterly earnings from Amazon and Apple dominated the headlines.

- The US NASDAQ has corrected ~8% over recent weeks from its March all-time high; a push higher towards 19,000 wouldn’t surprise from here.

The UK FTSE again posted new all-time highs on Friday night, with tech and retail stocks leading the charge as bond fears dissipated following the market-friendly US employment data. Hiring slowed sharply in April, and wage growth eased without signalling a serious deterioration in the jobs market.

- No change; We remain bullish towards the UK FTSE, a positive read-through on the highly correlated ASX, especially the miners.