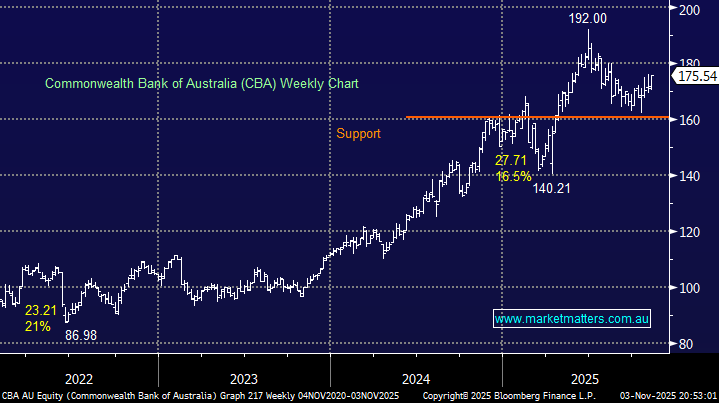

CBA is a world-class bank, but it’s often accompanied by the unattractive tag of being the world’s most expensive. Even while trading ~9% below this year’s high, it’s trading more than 30% above its average 5-year PE. The stock is only forecast to yield 2.8% fully-franked over the next 12-months, which doesn’t scan well compared to say ANZ on ~4.6% (part-franked). Hence, the only reason to buy CBA into Christmas is for capital gain, and as we said, it’s expensive, and MM sees better opportunities elsewhere. A point of note is that CBA may outperform if/when we see a meaningful market pullback, as it’s often regarded as a defensive play.

- We like the risk/reward towards CBA back under $150, almost 15% lower, a move which feels unlikely in the short-term.