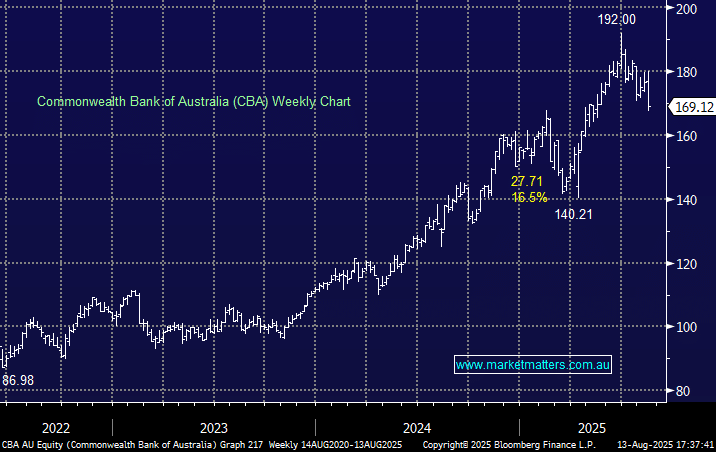

CBA -5.41%: posted a decent FY25 result but failed to deliver the material beat required to sustain its stretched valuation with the shares trading down as much as -6%.

- Cash earnings of $10,252m matched consensus, with revenue supported by a ~$125m trading income uplift.

- NIM was steady at 2.08%, and loan growth (~1% ahead of market) was driven by institutional/business lending.

- Operating expenses of $12,996m were slightly above forecasts, reflecting elevated technology investment.

- Dividend per share was steady at 485cps.

There were clearly concerns over the quality of the revenue beat with a one-off sugar hit from their trading division, as well as higher costs. While CBA retains strong funding, total investment spend rose ~10% HoH with, though this will ultimately reinforce their best-in-class status as a tech-first bank.

Today’s result and share price reaction might be a ‘I told you so’ for the analyst community who are heavily negative on the stock valuation concerns. Based on its track record, we’re not counting biggest name in the index out by any means.