CBA -6.59%: Shares fell sharply today after the September quarter trading update was largely inline with expectations, though margin pressure persisted despite solid profit growth and healthy lending momentum.

- 1Q FY26 unaudited cash profit came in at $2.6bn, up 2% YoY (and ~1% above the prior two-quarter average).

- Loan impairment expense was modest at $220m, with credit quality still sound and arrears improving across both consumer and corporate portfolios.

- Operating income rose 3%, helped by lending and deposit volume growth plus 1.5 extra trading days in the quarter.

- Operating expenses increased 4%, reflecting wage and IT vendor inflation, partially offset by productivity gains.

The key drag was a reduction in headline net interest margin (NIM) — impacted by a mix shift toward lower-yielding liquid assets and institutional repo transactions. Analysts flagged this as the soft underbelly of the result.

CEO Matt Comyn said the bank is “closely watching the increased competitive intensity” and remains “cautious given geopolitical and macro uncertainty.” CBA held total credit provisions flat at $6.4bn, underlining a conservative stance.

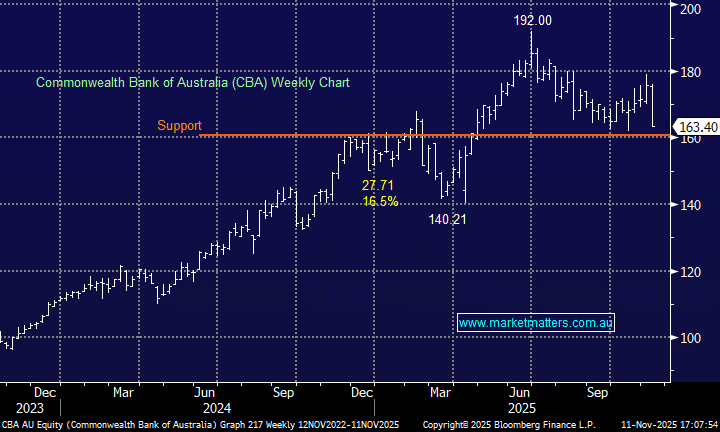

Despite today’s pullback, CBA remains the world’s most expensive major bank, trading on ~27.4x forward earnings — a premium that looks difficult to justify while NIMs compress and costs rise.

While CBA remains best-in-class operationally, margin headwinds and an uncompromising valuation leave limited room for error. While the update confirms the franchise remains strong, it also reinforces our preference for cheaper peers like ANZ & WBC that offer greater leverage to any recovery in credit growth without paying a tech-stock multiple for a bank. We have no exposure to CBA across Market Matters Portfolios.