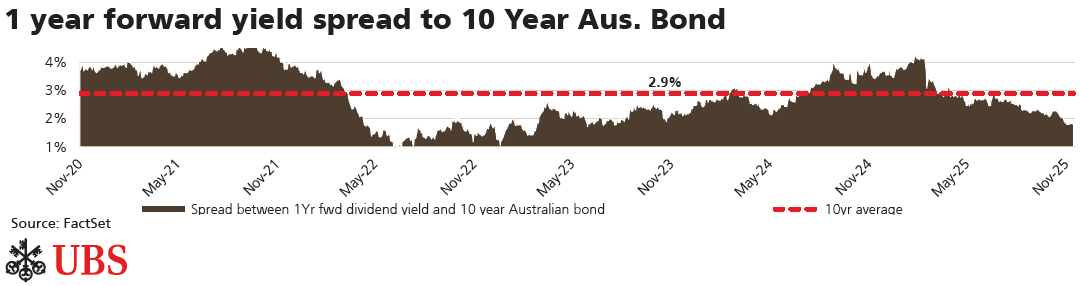

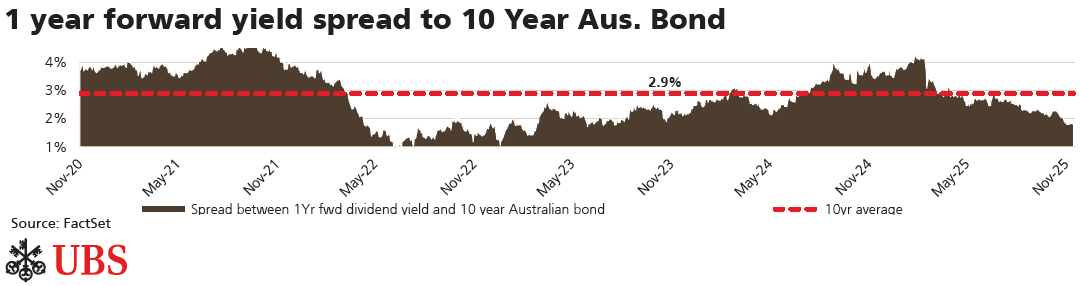

We discussed APA Group (APA) in a Q&A last week (here), highlighting APA’s spread over 10 year yields as our primary indicator on this stock. In the answer, we highlighted it’s spread vs US 10 year yields (global benchmark for rates) at 2.2% (APA yield exp at 6.2%). Since then, UBS highlighted this indicator relative to Australian 10-year yields, which trade around 40bps higher than their US counterparts, as they reinforced their sell rating on the stock. There is no doubt APA is now on the more expensive side of history as the below chart highlights, and we see less growth upside in this holding, though in absolute terms, a 6.2% partially franked yield remains attractive in the Income Portfolio (but less so in the Growth Portfolio).

Relative to Australian 10’s, APA’s yield spread now sits ~1.8%, relative to its 5-year average spread of 2.9%. You’ll notice in 2022 the spread was materially lower, with the share price trading above $12, before a large re-rate down to ~$6.60. APA is now back within the mid-point of that range, implying it’s moved from undervalued to mildly overvalued – though we do think these sorts of defensive stocks with predictable earnings more often than not can hold higher valuations, particularly in an environment where uncertainty remains elevated.