APA had been struggling into this week’s result, with shorts steadily building up towards 4.7%, the highest level in years, as traders laid bets that a capital raise was imminent. Monday’s solid result and accompanying commentary scuppered this thesis, sending the stock up +16.5% in just two days; we’re sure investors who believe short-selling stock is immoral enjoyed this one! While the gains are likely partly due to “short-covering,” we believe the underlying bullish thesis we’ve discussed around APA for the last year is finally playing out.

- Gas pipeline giant APA is confident it can self-fund its ambitious growth plans, negating concerns around a looming capital raise.

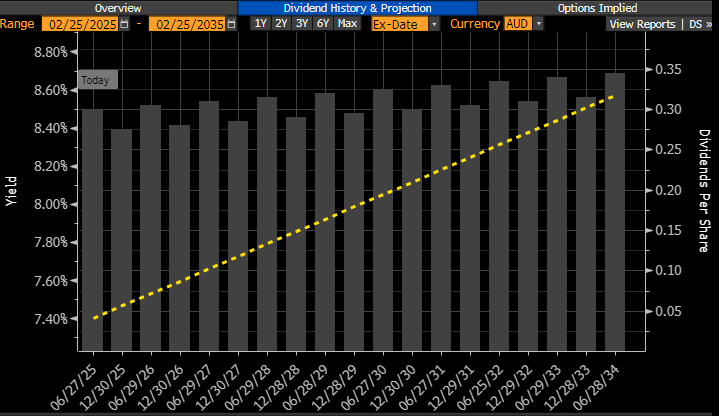

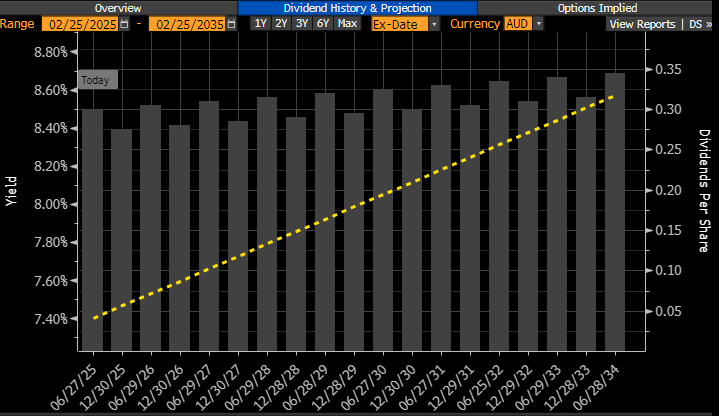

On Tuesday, APA reconfirmed its FY25 Earnings (EBITDA) forecast of $1.96-2.02bn and FY25 distribution of $0.57 per share. However, the main positive for MM in the interim result was APA’s statement that it could internally fund its planned $1.8bn organic growth programme over the next three years, i.e., no capital raise. It was also encouraging to see the firm progressing with enterprise-level cost reduction initiatives to deliver efficiencies, with Boston Consulting looking at the obvious job cuts, plus moderating costs through its supply chain and operating model. The margin outlook is increasingly attractive with cost growth running below inflation while the company enjoys inflation-linked earnings.

- With APA management confident that their steady cash flow of ~$560mn and balance sheet capacity can fund their expansion plans comfortably, the all-important yield shouldn’t suffer.

Even after the surge over the last 48 hours, APA is set to yield ~7.5%, with this forecast to grow steadily over the coming decade. Credit markets are currently pricing the RBA Cash Rate to fall to 3.6% by Christmas, which makes APA even more attractive moving forward hence, we expect an ongoing re-rating of this utility, not just a two-day short squeeze.

- We continue to like APA’s yield story over the coming years, hence we hold the stock in our Active Income Portfolio.

We are initially targeting the $9 area for APA, which would still put the utility on an attractive ~6.3% yield. To put things into perspective, that’s only back to where It was training in the middle of 2024 and in our opinion, the outlook has improved for APA since then, especially with uncertainties being removed.

- We are looking for a further 15-20% upside for APA. Hence, we hold the gas utility in our Active Growth Portfolio.