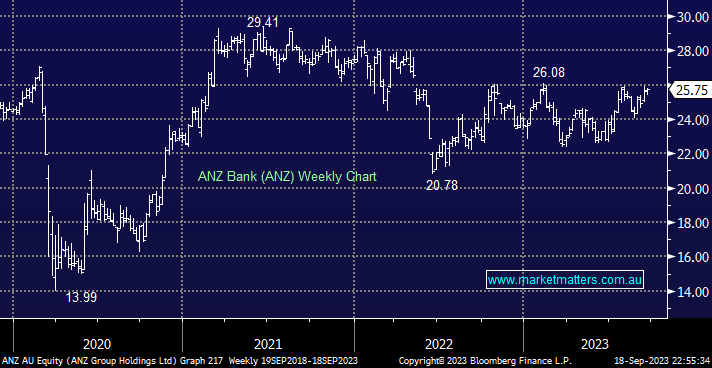

ANZ has been the best performer of the “Big Four” banks in 2023, advancing +8.8%, with CBA a distant second, up only +0.03%. The bank released a trading update last month, and while it was light on in detail following a lower-than-expected impairment charge, we can see upside risk to consensus earnings. We remain bullish toward ANZ, initially targeting a test of $28 over the coming months, while an estimated yield of 5.8% fully franked over the next 12 months makes holding the stock fairly easy.

In terms of the potential purchase of Suncorp (SUN) banking arm, the bank appears committed to getting this deal completed despite some wide-ranging pushback, but at least during this period, ANZ still benefits from a positive carry on the $3.5bn capital raised.

- We hold 6% of our Flagship Growth Portfolio in ANZ, which feels the correct weighting at this stage.