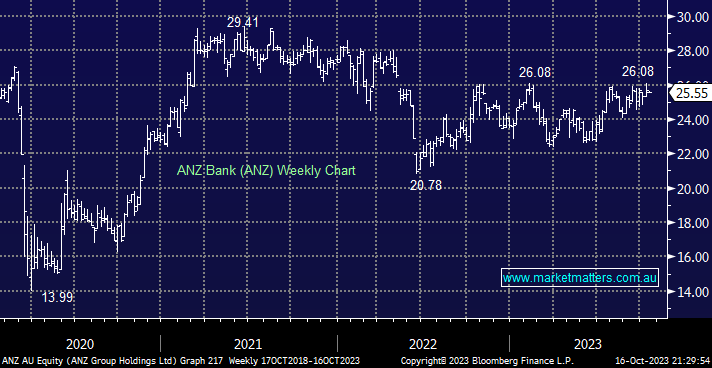

ANZ is the top performing ASX200 bank in 2023, having rallied +8% year to date. Even after recent outperformance, ANZ remains our preferred bank for growth, while an estimated yield of 5.8% fully franked over the next 12 months makes holding the stock fairly easy. A sustained turnaround in mortgages and the valuation story behind ANZ remains attractive. ANZ is trading at ~1.0x book value and at historical averages, compared with other major bank peers that are above their historical averages, but the market is expecting a strong result on the 13th of November.

- No change, we are bullish on ANZ, initially targeting a test of $28 – MM holds ANZ in our Flagship Growth Portfolio.