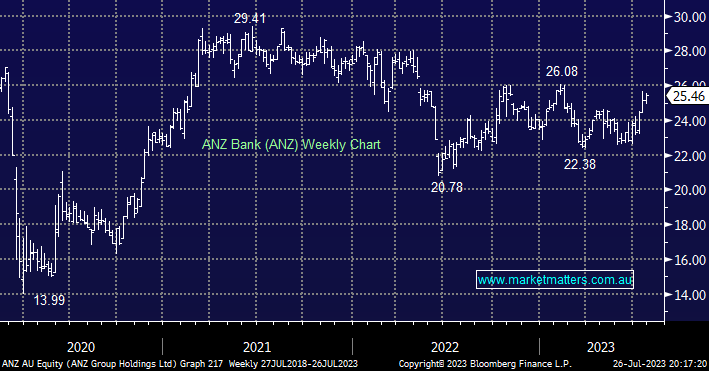

ANZ, like the whole banking sector has advanced steadily through July taking its gain for 2023 to ~6%, however, most of the sector remains down year-to-date. Bond yields look to have peaked while employment remains strong, the implication being that bad debts will be far better than many feared into 2024 which is helping steady the banking ship plus ANZ is still forecast to yield 5.85% fully franked over the next 12 months, not bad if the Cash Rate is set to peak at 4.1% before turning lower in 2024.

- We are initially targeting a test of $28 over the coming months i.e. over 10% higher.