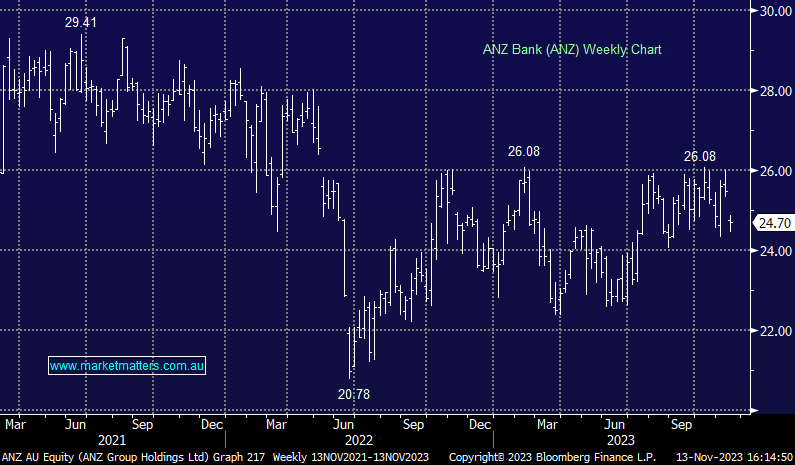

ANZ -3.02%: Reported FY23 results this morning which were around 1.5% below consensus in terms of cash profit. Net Interest Margin (NIM) was weak, about 6bps below expectations but a more significant -33bps half on half for Australian retail NIM which highlights how hard ANZ went to gain market share (via low rates which compress margins). It did work to a large degree with ANZ growing home loans well above system, CEO Shayne Elliot today was unapologetic for prioritising growth, but there is an offset and we saw that in these results.

The dividend was solid, and around 15% above consensus although it was only partially franked. At 81cps for the half 65% franked + an unfranked 13cps one-off dividend to account for the lower franking means that investors are getting $1.16, smack on what a fully franked 81cps dividend is worth. ANZ remains cheap trading on 1.1x book value and a PE of 10x, both below historical norms.

- We continue to like ANZ from a relative perspective, seeing the most upside across the sector.