1H23 results out this morning that showed a few swings and roundabouts, but broadly inline with expectations:

- record half-year cash profit of $3.82bn, inline with $3.81bn consensus

- interim dividend of 81¢ per share was 2¢ higher than expected and up 9¢ on the interim payout last year.

- Net Interest Margin (NIM) +0.07% to 1.75% v 1.83% expected, however strip out the influence of markets and NIMs were 1.83% – this will be an area of disappointment while Shayne Elliot also spoke to a tougher 2H to come – much the same as NAB yesterday.

- They said there was a tailwind on margins from its institutional bank, while Australian housing provided a headwind due to competition – not sure what the exit-margin was.

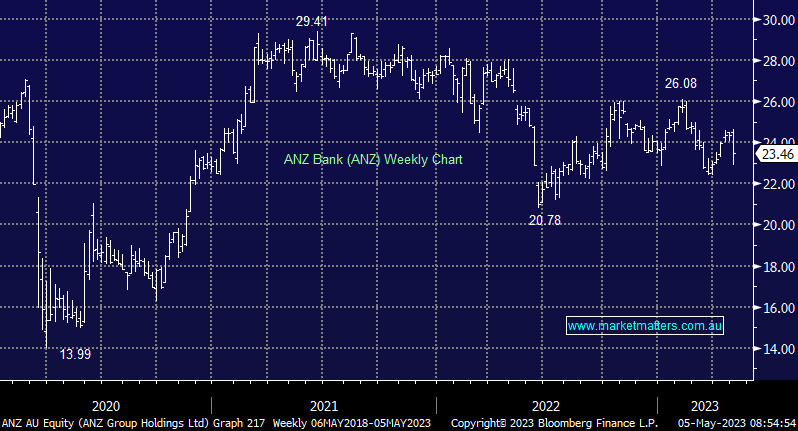

- The main difference between ANZ & NAB is valuation – ANZ trades on 1.0x book, NAB is on 1.4x book