- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

- 1H26 Reporting Calendar: Spreadsheet Version Here, PDF Version Here

“If I get this right, we were smart enough to invent AI, dumb enough to need it, and so stupid that we can’t figure out if we did the right thing”. Jerry Seinfeld

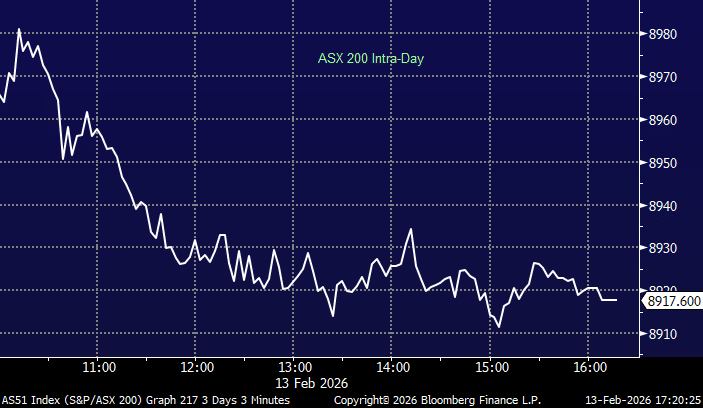

The ASX pulled back sharply today as AI-related margin fears continued to drive aggressive selling across software and high-multiple names. Despite the weak finish, the market still closed the week up ~2.4%, underpinned by a fantastic week from the banks on better-than-expected results.

- The ASX200 fell –125pts/-1.39% to close at 8917

- Utilities (+3.38%) and Property (+0.85%) the only two sectors higher

- Technology (-5.06%), Healthcare (-4.04%) and Consumer Discretionary (-2.36%) weighed.

- Austal (ASB) -22.8% slumped after cutting FY26 EBIT guidance by 18% to $110m following a financial error linked to US Navy contract incentives.

- Cochlear (COH) -18.9% 1H NPAT fell 21%, with FY guidance flagged to the lower end. Delays in Nexa uptake and softer implant sales weighed heavily.

- Webjet Group (WJL) –25.2% ended takeover talks with Helloworld and BGH Capital and cut FY26 EBITDA guidance, triggering heavy selling.

- Nick Scali (NCK) -22.3% strong 1H result overshadowed by soft January sales growth in Australia/NZ, raising concerns about 2H momentum.

- GQG Partners (GQG) +7.8% one of the few bright spots after a small earnings beat, strong fee margins and stabilising FUM supported sentiment.

- Westpac (WBC) -1.2% eased despite a better-than-expected quarterly profit, as margins compressed.

- ANZ Group (ANZ) +1.3% bucked the trend after a broker upgrade, highlighting relative value versus peers.

- AMP (AMP) +9.0% sharp rebound following its steep sell-off earlier in the week – multiple broker upgrades this AM

- WiseTech Global (WTC) -10.4% hit on AI related concerns specifically targeting transport business

- Xero (XRO) -4.5% sold alongside peers on “SaaSpocalypse” fears, despite Morningstar flagging XRO as oversold given sticky accountant networks.

- Gold recovered $US30/oz to be trading $US4955/oz around our close.

- Iron ore was down 1.4% at $US98.30/mt

- Asian markets were down, with China off -0.9%, Hong Kong off -2% and Japan down -0.9%

- US futures are down -0.2%