GMG is known as one of Australia’s largest industrial property and logistics real-estate players, however, they are now making a substantial strategic shift into the data-centre / digital infrastructure business. Rather than just warehousing and logistics parks, Goodman is now positioning itself as a globally relevant “digital landlord” supporting cloud, hyperscale, AI and data-driven customers.

There are several key elements required to be successful in this space, and GMG has a competitive advantage in most.

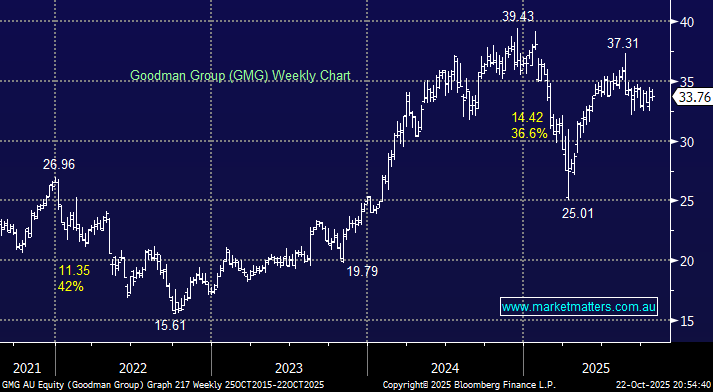

- Capital: GMG undertook an equity raise of A$4 billion at $33.50 to fund its data-centre expansion. They are cashed up now, and will access to capital in the future.

- Sites: They are leveraging their existing industrial land bank and access to power & fibre to re-use or repurpose sites (industrial → data centre) especially in high‐demand zones.

- Power: GMG has a “global power bank” of 5 GW across 13 major cities. Of that, ~2.7 GW is already secured, with another ~2.3 GW in advanced procurement.

- Customers: GMG has incredible relationships around the globe and has worked with major technology companies on industrial developments.

The GMG DC offering ranges from “powered site” (land with power & connectivity) through to “powered shell” (structure + infrastructure) and fully-fitted data-centre facility (turnkey, ready for hyperscalers).

Greg Goodman is a great operator, and we like the way the broader business is structured. Remuneration, while high, is heavily linked to the businesses overall financial performance, creating great alignment across the business with investors.

Earnings jumped almost 10% in FY25 and Goodman expects another 9% lift this financial year. While the growth is lower that recent years, the front loading of work relating to DC development is high, as they lay the foundation for stronger growth in outer years. From a valuation perspective, GMG is trading on the same multiple it was when it was ‘just’ an industrially focussed shed business, and while the move into DC’s does create more risk, we are backing Greg and his team to execute, underpinning it’s next leg of growth.

- We continue to like GMG for growth and exposure to data centres.