Overnight we heard that LYC was going to raise $750mn to fund its expansion as western firms respond to Beijing’s supply shock. In April 2025, China imposed sweeping export controls on seven critical rare-earth elements and permanent magnets, requiring exporters to obtain licenses, which severely squeezed global supply chains. It then quietly issued 2025 mining and smelting quotas exclusively to a limited number of state-owned firms, while expanding its quota system to also cover imported raw materials, further tightening control over the market. As a result, rare-earth magnet exports plunged, particularly in the first half of 2025, export volumes dropped nearly 19%, leading to price spikes and supply chain disruptions globally.

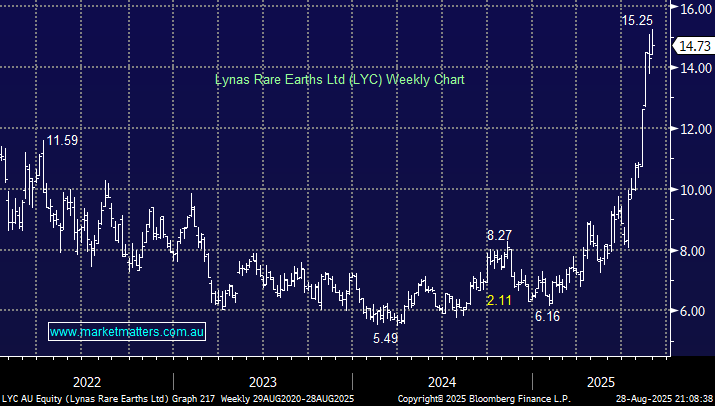

Chinas actions have benefited LYC’s share price which has doubled in recent months. Hence the rare-earth producer’s timing is on point with LYC looking to issue shares at $13.25, a 10% discount to the last price. The company, backed by Australia’s richest person, Gina Rinehart, plans to use the funds to streamline existing operations, modify an existing mine and expand Malaysian processing plants.

- We like LYC around $13 but its going to be a volatile journey over the coming years.