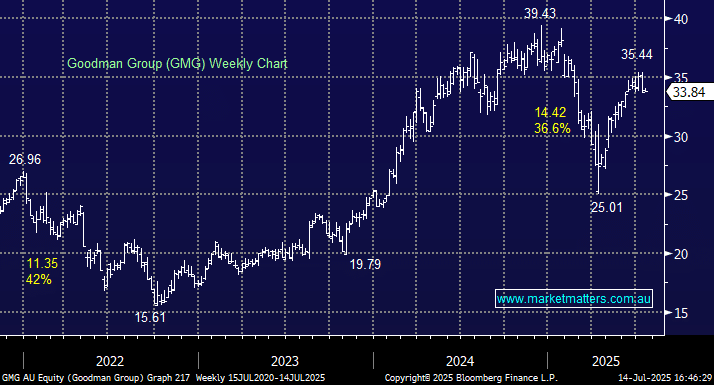

GMG has bounced ~40% after selling off aggressively following its massive $4bn cap raise in February for data centre (DC) expansion. Before the raise was even digested, “Liberation Day” was upon us driving the stock lower, not great timing, albeit a short-term speed bump in the big picture. In late May, GMG reaffirmed guidance while delivering some encouraging commentary on its expansion into DCs – at this stage, GMG remains our preferred stock for exposure to the relatively new and exciting DC industry.

- We can see GMG making new highs back above $40 into 2026, although it might be ready for a “rest” in the $35 area: MM is long GMG in its Active Growth Portfolio.