It’s been covered extensively for almost a year how analysts believe Australia’s largest/premium bank is over-priced – the MM website shows of the 13 major brokers who cover CBA there are 1 Hold & 12 Sells- probably why being short CBA is often referred to as the “widow maker” trade. We touched on CBA on Wednesday morning, saying “we believe it is overvalued trading on 28.5x 1 year forward (though we still hold it in the Income Portfolio).

The certainty trade that we’ve discussed several times, has also been obvious within the banking sector itself. CBA offers a phenomenal track record of execution, and little surprises when it comes to financial performance, whereas the other three have at various times made strategic mistakes and/or failed to execute, which has reduced their return profiles over time. If certainty in an uncertain world is the playbook, we totally get why CBA attracts the capital.

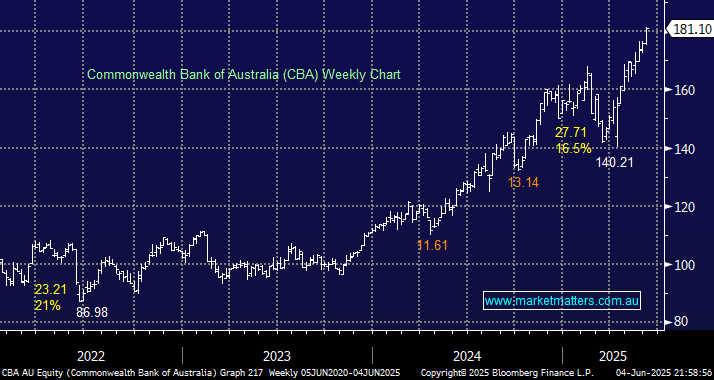

For that reason, MM is not fighting the tape like many, and we are long in our Income Portfolio, although it’s becoming increasingly thin on the yield front as the stock extends its 2025 gain to over 17%.

- If the market squeezes up towards our targeted 9000 level, we can see CBA testing $200 into Christmas: MM is holding CBA in its Active Income Portfolio.