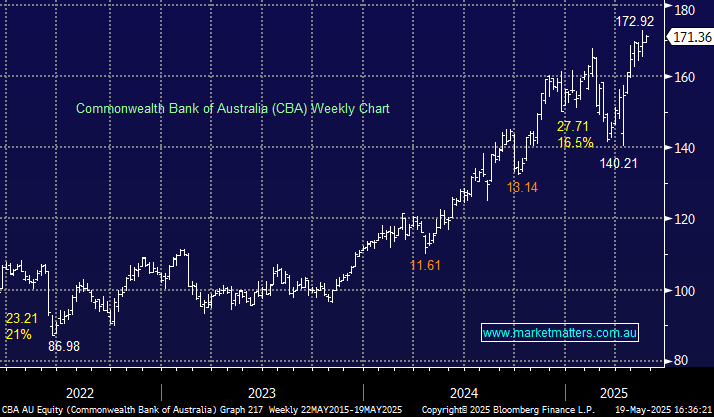

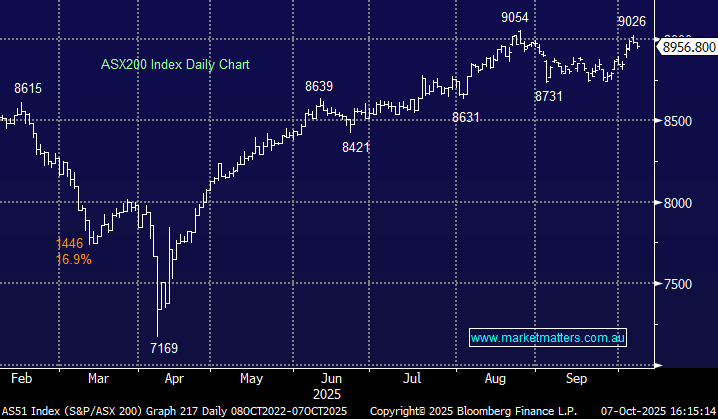

CBA extended its 2025 advance by 1% on Monday, taking it up 12% year-to-date, while ANZ fell 1.7%, joining NAB and Westpac in negative territory for 2025. Australia’s largest bank continues to enjoy a “safety bid” from local and overseas investors with relative disregard to valuation, especially when compared to historical levels. If we are correct, and the ASX200 punches to fresh all-time highs, we believe the heavy lifting will be performed by the likes of underperformers ANZ, as opposed to the high-flyers, although they still look well-positioned to post fresh all-time highs.

- We can see CBA testing $180 in 2025, but the outperformance feels stretched: MM has long CBA in the Active Income Portfolio.