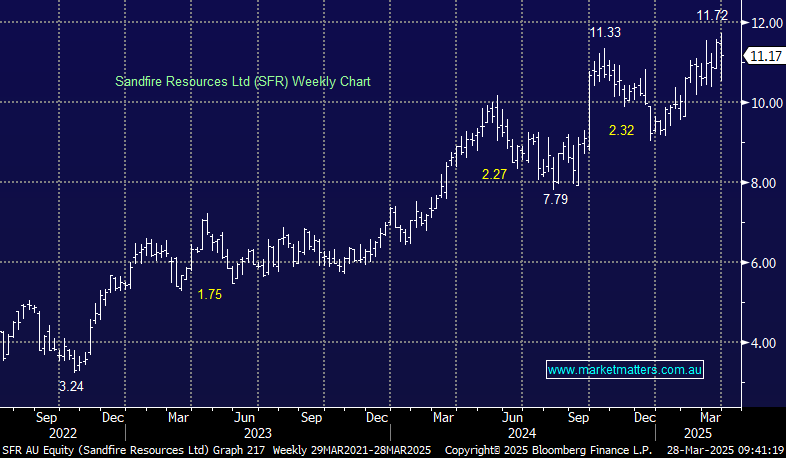

We continue to like the medium term drivers for Copper, and believe Sandfire Resources (SFR) is delivering operationally, however, in the short term, we think there are risks around the sustainability of the move. We are locking in a ~70% profit on the position.

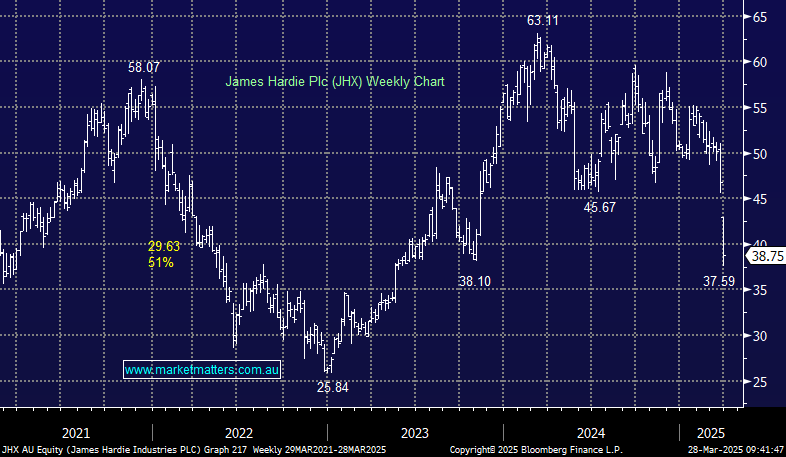

James Hardie’s (JHX) recent (proposed) acquisition has put the stock under pressure as the market prices in weaker short term growth and acquisition risk, however, we view the deal as very positive in the medium term, and believe the sell-off is complete.