GMG is an excellent company that has rewarded investors, including MM, with stellar returns this year. However, we took profit into strength on valuation grounds in August – a dangerous move for some stocks at times in 2024. Our stance hasn’t changed over recent months or following GMG’s recent confirmation of guidance: they still expect operating EPS to be up +9% for FY25. However, the issue is around market expectations, with consensus being 13.1% growth. As we witnessed with Nvidia this week, expectations can get ahead of themselves for quality top-performing stocks.

Data Centres now account for over 40% of work in progress, and this will continue to increase as the company evolves with this new megatrend. We expect to own this company at some point in 2025, with price and time as the main variables. Note that we are not too proud to buy back in at a higher price than we sold if a pullback doesn’t unfold.

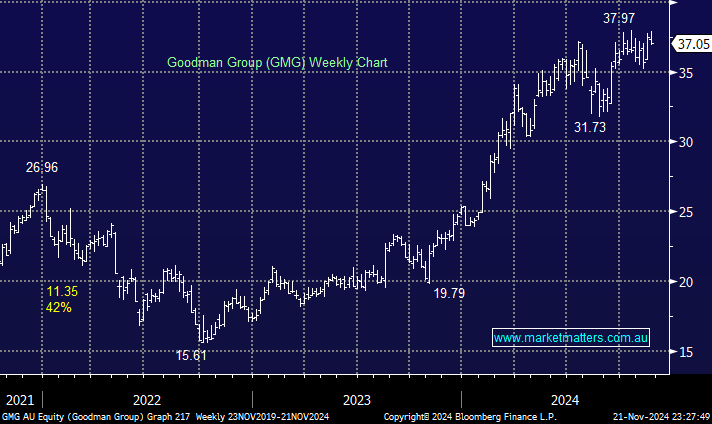

- We continue to like GMG back towards $30, where it was trading 6-months ago.