MFG +7.6%: FY24 results were a touch ahead of expectations and they announced an interesting deal to buy a 29.5% stake in Vinva Investment Management for $138.5m cash.

- Revenue of $345.6m was ahead of the $321m expected

- Adjusted NPAT of $177.9 million, +2% y/y vs $177.2 million consensus

- Final dividend per share $0.357

- Average funds under management A$36.82 billion, -25% y/y

- Cost reduction has been a big driver, with funds management business expenses $102.4 million, down -16% on the year, but a shade (~$2m) above target.

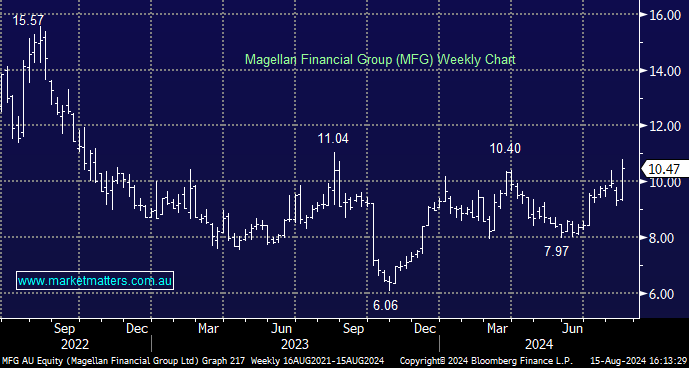

We’ll go out on a limb and say this result is the turning point for MFG, as they move from a period of contraction and putting out fires, to a period of growth. Net outflows are moderating, and they actually saw institutional inflows of $0.6 billion in 4Q and further positive flows in July. Vinva looks a good addition that could have an immediate positive impact on earnings, while their stake in Barrenjoey is shaping up very nicely – Barrenjoey is killing it reporting FY24 NPAT of $34.7m following record revenues up over 40%, while they intend to start paying dividends given the growth in earnings (subject to board approval)