What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

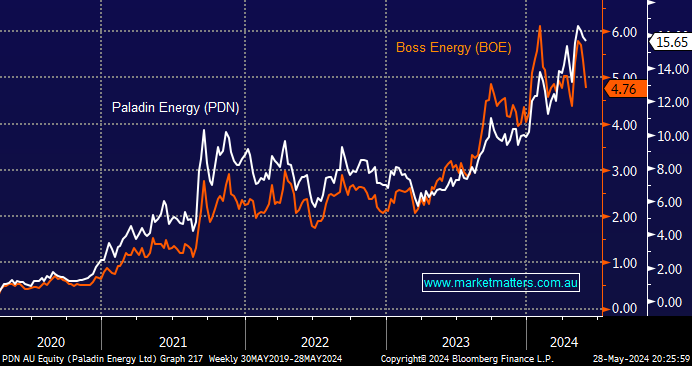

The questions ran hot yesterday around Boss Energy (BOE), even after we touched on the leading ASX uranium stocks on Tuesday following the news that the company CEO had sold over 70% of his shares in the uranium miner. Also, for good measure, the Chairman and another director also sold smaller parcels of stock. We can see the logic in taking some $$ off the table after the stock/sector’s great run in recent years, but all things being equal, they clearly don’t believe it’s going to double again anytime soon.

- The “insider selling“ saw BOE plunge over 10% on Tuesday, with investors following the board into cash.

- We see no reason to chase BOE at current levels, and we can still see a move down towards $4 or another 15% lower.

We maintain our preference for PDN over BOE, but in a similar fashion, we are unlikely to buy back into PDN in our Active Growth Portfolio around current levels, nearer $14 would be more appealing. MM does remain long PDN in our Emerging Companies Portfolio.

- One trigger we will consider with regard to buying PDN is the BOE share price; if it does test $4, it will generate one reason to increase our uranium exposure, albeit via PDN.

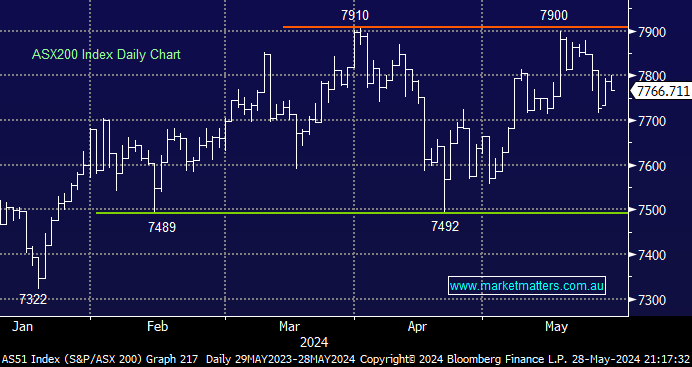

The ASX200 surrendered early gains to close down -0.3% on a disappointing Tuesday, with over 70% of the mainboard closing lower. Overall, the local market is feeling tired at the moment, with buyers noticeably absent into any strength. We’re not throwing in our bullish towel just yet, but we are becoming increasingly conscious that the ASX is struggling to around current levels.

Tuesday saw the Retail Sector weigh on market sentiment after Retail Sales for April missed expectations, although it wasn’t a major outlier for this relatively volatile data print. The larger issue is the wounded sentiment towards the sector after some recent company downgrades as the Australian consumer struggles in the face of persistently high interest rates and the ever-increasing cost of living. However, the selling was controlled, and although all members closed lower, the worst performer was only down -1.4%.

- This morning, the SPI Futures are pointing to a weaker opening, down around -0.6% following overnight weakness in US bond markets and European equities.