What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

The ASX200 traded higher on Monday, but it was a market of two halves; even with the index rallying almost 50-points, less than 60% of the main board managed to close in positive territory. However, when the major miners rally strongly, and the “Big Four” banks all play a supporting role, the ASX is likely to enjoy a strong day at the office:

Winners: Evolution Mining (EVN) +5.2%, Sandfire (SFR) + 3.9%, South32 (S32) +3.5%, RIO Tinto (RIO) +2.8%, Woodside (WDS) +2.1%, BHP Group (BHP)M +1.9%, and Westpac (WBC) +0.8%.

Losers: Audinate (AD8) -5.9%, Cochlear (COH) -3.2%, ARB Corp (ARB) -2%, Ansell (ANN) -1.9%, a2 Milk (A2M) -1.6%, Lovisa (LOV) -1.5%, and Goodman Group (GMG) -1.1%.

We remain bullish on the local index, targeting a clean break above the psychological 8000 level. It’s not hard to ride the bullish wave at the moment, with US and European equities posting new all-time highs almost daily while Copper and Gold continue to buoy sentiment across the influential Resources. In addition, bond markets have calmed after April’s interest rate jitters, although we shouldn’t lose sight of how easily credit markets change direction after just a few economic numbers – US Futures are pricing in two rate cuts by January 2025.

- We are looking for a break of 8000 in the coming weeks/months, but the advance’s drivers are likely to be very stock/sector specific.

Wall Street ended mixed overnight, with the Dow falling -0.5% while the tech-based NASDAQ advanced +0.7%, aided by strong moves from Netflix (NFLX US) and Nvidia (NVDA US) ahead of its result on Thursday morning (AEST). The indices largely trod water after making fresh all-time highs last week because of the renewed hopes of rate cuts moving forward while US companies are delivering better earnings than expected, but this week will largely be driven by AI giant NVDA, where analysts are looking for revenue to be up 11% quarter on quarter to $US24.69bn.

- The ASX200 is set to open down -0.1% this morning following the mixed session on Wall Street, although BHP closed up ~45c in the US as the Wednesday final deadline for it to increase its bid for Anglo American looms.

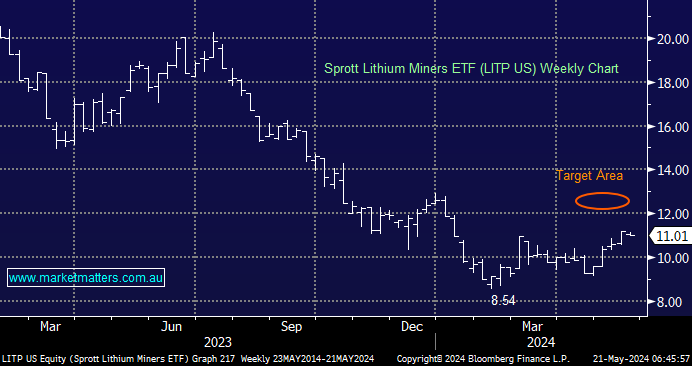

It’s hard not to look at the miners this morning as gold and copper surge higher; hence, we’ve compromised and quickly revisited three lithium plays six weeks after we posed the question – “Are lithium stocks about to pop on the upside?”.

Since our last report, the Lithium ETF (LITP US) has advanced ~9%, taking it halfway to our $US12 target area. So far, so good. However, the stocks in the ETF have experienced a mixed performance. This morning, the major five holdings are Mineral Resources (MIN), Pilbara Minerals (PLS), Albemarle (ALB US), Sociedad Quimica, and IGO Ltd (IGO), in an industry where Australian miners play a major role.

- We remain short-term bullish towards lithium miners, initially targeting ~8-10% upside from current levels.