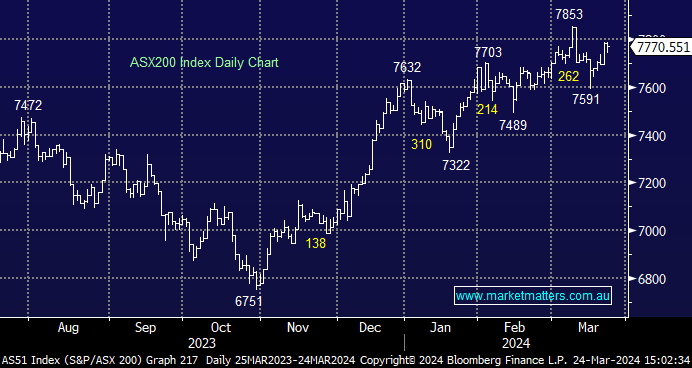

The ASX200 enjoyed a solid penultimate week of March, taking solace from the FOMC’s read on interest rates with the Materials, Real Estate and Financials leading the advance, whereas weakness in the Consumer Staples and Utilities Sectors illustrated it was another week of “risk on” for stocks. In line with global equities, especially the European stocks, our preferred scenario is to see a test of the 7900-8000 region over the coming weeks. Still, we are conscious that the seasonally weak “sell in May & go away” period is approaching fast.

- No change; We remain bullish on local equities, but subscribers should remember that the market’s “three-step forwards, two-step back dance” will likely continue this FY.

- The SPI Futures are pointing to a small + 0.1% advance this morning as the highly correlated FTSE’s strong performance helped outweigh the sentiment from the mixed session on Wall Street.

US equities rallied another +2.3% last week on broad-based buying following the FOMC, which saw all 11 sectors close higher. However, interestingly, the headline-grabbing Tech Sector was only third best after the Industrial and Communication Sectors. Every week that US stocks post fresh highs makes the advance from their last 2023 low look more impulsive. The next 500-point pullback might start at 5500, 6000, or even higher!

- We can see further upside for US stocks through 2024 as the bull market marches higher – remember, surprises remain most likely with the trend, i.e. on the upside.

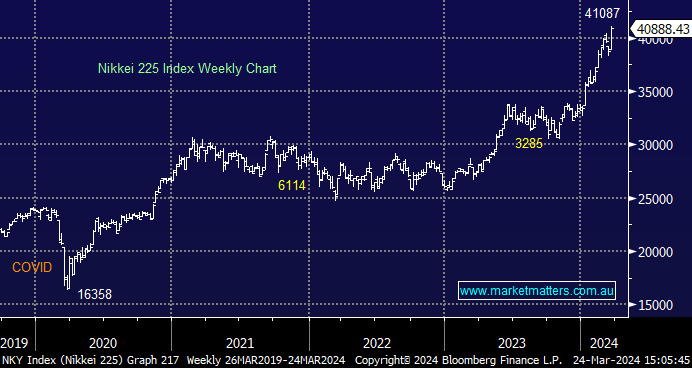

Japanese equities surged to all-time highs last week even as the BOJ hiked rates albeit back to a paltry 0-0.1% target. However, the combination of a weak Yen, which is great for exports, and expectations that rates will remain comparatively low have been enough to ignite the Nikkei. The Nikkei also benefits from its high concentration of semiconductor stocks, with the index climbing 25% in less than 6 months buoyed by the strong performance of Japan’s previously unnoticed gems in the global semiconductor industry. On Friday, chipmaking equipment manufacturer Tokyo Electron climbed 5% at one point and reached a new record high.

- We continue to like Japanese stocks in pullbacks, but they may need to “take a rest” after recent strong gains. Again, we are conscious that surprises usually unfold with the trend.