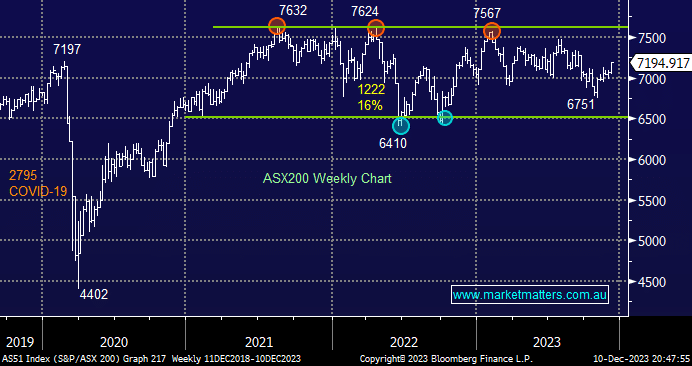

As subscribers know, the “Christmas Rally” doesn’t usually gather momentum until the 2nd half of the month as significant dividends start hitting investors’ accounts. However, the ASX200 is doing fine so far; it’s already up +1.5% month to date. While the ASX200 can hold above 7080, our preferred scenario is the local index is heading towards its 2023 high, especially as global equities remain firm in the face of theoretically bearish news.

- The SPI Futures are pointing to a firm opening this morning, up around +0.2%, with gains likely to be led by the energy and tech stocks, assuming we follow the moves across US indices on Friday night.

- Remember, if the historically more robust December only matches November, the index will at least test the July 7475 swing high before we sing “Auld Lang Syne”.

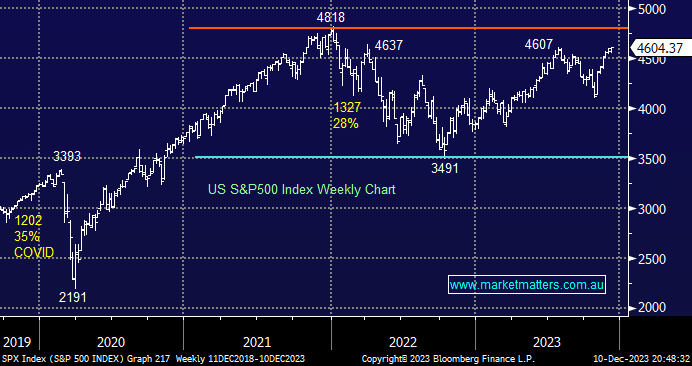

US stocks closed firmly last week, with major indices advancing for a 6th straight week, with the S&P500 closing less than 0.1% below its 2023 high. We continue to believe global and US stocks can maintain their upside momentum into 2024. Still, we are looking for the US major indices to underperform the ASX as the influential “Magnificent Seven” tire after a stellar advance through 2023, i.e. year to date, the NASDAQ is up +47%, compared to the S&P500, which has advanced +19.9%. The poor ASX200 is only up +2.2%, due to its lack of influential mega tech/AI names.

- No change; the FANG+ & NASDAQ Indices followed the MM roadmap to fresh 2023 highs; we are now expecting the broad-based S&P500 to follow, no longer a big call, it’s now less than 1% away.

- All-time highs for the S&P500 are only 4.4% away, not out of the question and if the index manages to match November’s advance, it will post a new milestone.

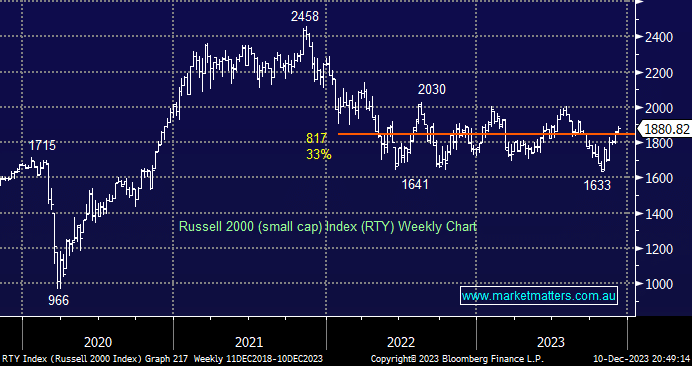

The US small caps outperformed their better-known rivals through November and have continued to do so into early December. However, even after the recent +15% recovery, the small-cap index is more than 20% below its 2021 high, which leaves plenty of room to squeeze higher if we encounter an absence of sellers into Christmas. On the ASX, we have seen some performance reversion over the last 6-weeks as yields turned lower, with small-cap names, both home and abroad, joining the 4Q rotation party as they benefit from lower interest rates.

- We can see the Russell 2000 (small caps) testing the 2000 area into Christmas, or +6% higher – a similar move would take the S&P500 to a new all-time high.