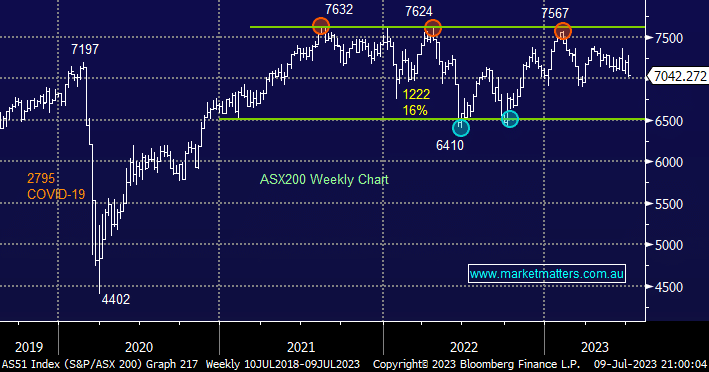

Over recent month we’ve been looking for short-dated bond yields to post fresh highs which unfolded according to the script, with the move dragging stocks lower as expected. If the next chapter of our roadmap is correct we should see yields form a top over the coming weeks which bar any economic calamities should prove very supportive of stocks – we remain buyers of weakness but we do expect the ASX to maintain its choppy characteristics into Christmas

- The SPI Futures are pointing to a +0.4% rally early this morning, with the resources likely to be supportive after solid moves in the US.

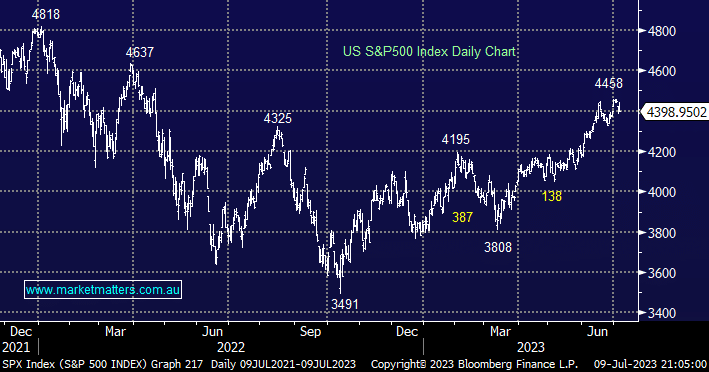

The broad-based S&P500 has slipped -1.3% from its 2023 high, a lot better than the ASX which has fallen over -3.5% from its June high and -7% from its February high. At this stage, we don’t believe the current pullback by US stocks is any more than a healthy move within a strong uptrend.

- Our target for the current pullback is the 4300 area, now only another 2% further.

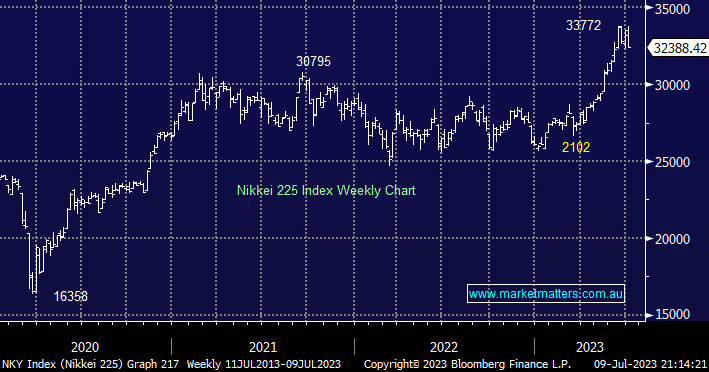

The Japanese Nikkei has significantly outperformed US stocks in 2023 having accelerated +27% from its March low, an excellent performance from the less often discussed bourse. Unlike most developed countries Japanese equities aren’t carrying the weight of surging inflation or rising interest rates, they still have rates around zero! We believe the Nikkei is in a very similar position to US stocks i.e. a simple pullback within an uptrend.

- Our “buy zone” for the Nikkei is around the 31,500 area, or 3% lower.